Are These 3 U.S. Tesla Challengers Worth The BUY?

Rating 3 U.S. EV Stocks as Tesla Faces Headwinds

Unless you’ve been living under a rock, you’re likely aware of Tesla’s recent struggles—slowing sales growth, intensifying competition, and the ongoing controversies surrounding Elon Musk, from his vocal political stances and leadership of DOGE (Department of Government Efficiency). With Tesla facing so many issues, investors should look at other options. Chinese brands like BYD are doing well, but are there any American EV stocks that could actually replace Tesla in your portfolio or represent a BUY opportunity? In this piece we will review three U.S. Tesla challengers based on their latest financial reports.

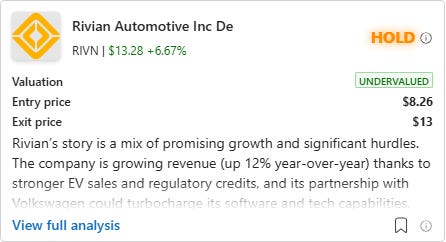

1. Rivian - RIVN

Rivian’s story is a mix of promising growth and significant hurdles. The company is growing revenue (up 12% year-over-year) thanks to stronger EV sales and regulatory credits, and its partnership with Volkswagen could turbocharge its software and tech capabilities, which are critical in the EV race. Costs are also improving—gross margins are less negative as raw material expenses drop and production gets smoother. But Rivian isn’t out of the woods yet. It’s still burning cash, with a $4.75 billion net loss in 2024, and its cash reserves are shrinking, down nearly 30% year-over-year. Shareholders are feeling the pinch too, as the company diluted shares by 17% to raise funds, a risky move if growth doesn’t accelerate fast enough. While the balance sheet looks stable today (more cash than debt), the path to profitability remains steep, especially with heavy spending on new models like the R2 and ongoing supply chain risks especially on tariffs.

For now, the stock’s volatility and uncertain short-term outlook make it a HOLD. Technical indicators like the bearish moving averages and oversold RSI suggest turbulence ahead, and Rivian needs time to prove it can turn its ambitious plans—like scaling production and leveraging its Volkswagen deal—into consistent results. Long-term investors might see upside if Rivian executes well, as its brand and tech partnerships position it as a potential EV leader. But until there’s clearer progress on cutting losses, stabilizing cash flow, and avoiding further dilution, caution is warranted. The company’s potential is real, but so are the risks—patience is key here.

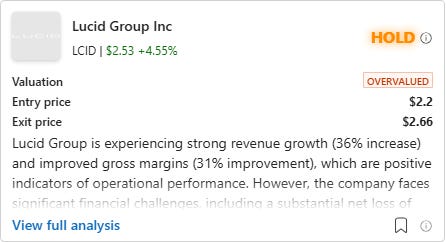

2. Lucid - LCID

Lucid Group is experiencing strong revenue growth (36% increase) and improved gross margins (31% improvement), which are positive indicators of operational performance. However, the company faces important financial challenges, including a substantial net loss of $2.7 billion and a growing accumulated deficit of $12.9 billion. The high cash burn rate and significant share dilution are concerning, as they could impact shareholder value and financial stability. Additionally, the recent resignation of the CEO adds uncertainty to the company's strategic direction. Despite these challenges, Lucid has a strong balance sheet with more cash than debt, which provides some financial flexibility. The company's strategic investments in technology and production capacity could drive future growth if managed effectively. Given the mixed outlook, a HOLD recommendation is appropriate, allowing investors to monitor the company's progress in addressing its financial challenges and executing its growth strategy.

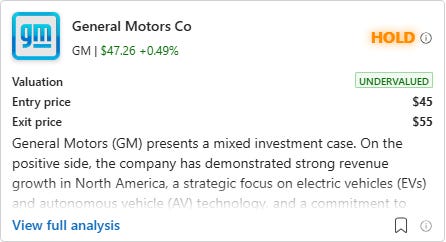

3. General Motors - GM

General Motors (GM) presents a mixed but cautiously optimistic outlook. On the positive side, the company delivered strong revenue growth (9% year-over-year) in 2024, driven by its core North American market where pickup trucks and SUVs continue to perform well. Strategic shifts toward electric vehicles (EVs) and advanced driver-assistance systems like Super Cruise position GM for future growth in evolving automotive trends. The balance sheet also shows improvement, with cash reserves rising to $14.5 billion and debt reduced slightly, signalling better liquidity. Share buybacks further highlight management’s focus on returning value to investors. However, challenges persist: international markets like China remain a drag (12.9% revenue decline in GM International), rising costs are squeezing margins (gross margin decline as costs grew faster than sales), and net income fell sharply to $6.0 billion from $10.1 billion in 2023. High capital expenditures (178% of net income) for EV development could strain cash flow in the near term, while regulatory hurdles and competitive pressures add uncertainty.

The stock’s technical indicators suggest short-term caution, with prices below key moving averages and bearish momentum signals (MACD crossover). Yet, GM’s valuation appears attractive with a low P/E ratio (7.41), implying the market may be undervaluing its long-term potential. For investors with a 3+ year horizon, GM’s strategic bets on EVs and autonomous tech, coupled with its strong North American foundation, could deliver growth as these initiatives mature. Near-term volatility is likely, though, given geopolitical risks and execution risks in its EV transition.

In conclusion, GM warrants a HOLD for now, as the stock’s current headwinds balance its long-term promise. Investors should monitor progress on cost management and EV margin improvements. Those with patience and higher risk tolerance might consider gradually accumulating shares for a BUY opportunity in the long run, betting on the company’s ability to navigate industry shifts and capitalize on its investments.