Capital One’s Big Moves: Strategic Mergers and Rising Profits – Time to Invest?

Capital One Financial Corporation has recently been in the spotlight due to its strategic merger with Discover Financial Services, which has faced regulatory hurdles but is now seen as more likely to proceed following a political shift in the U.S. administration. This merger, valued at $35.3 billion, is expected to enhance Capital One's market position significantly. The company's stock has also been influenced by broader market trends, including expectations of regulatory changes under the new administration, which are perceived as favorable for financial institutions. Additionally, Capital One has announced a quarterly dividend of $0.60 per share, maintaining its commitment to returning value to shareholders.

Fundamental Analysis

Revenue and Profitability

In the third quarter of 2024, Capital One reported a net income of $1.8 billion, slightly down from $1.79 billion in the same period of 2023. The company's total net revenue increased by 7% year-over-year to $10.0 billion, driven by higher net interest income due to increased loan balances and margins, particularly in the credit card segment. However, the provision for credit losses rose by 9% to $2.5 billion, reflecting higher net charge-offs. Operating expenses also increased, primarily due to growth in the credit card business and marketing expenses. The company's efficiency ratio, a measure of operating expenses as a percentage of revenue, slightly worsened to 53.07% from 51.89% in the previous year.

Strategic Positioning

Capital One's strategic initiatives include the merger with Discover, which is expected to create synergies and expand its customer base. The company is also focusing on digital transformation and enhancing its technology infrastructure to improve customer experience and operational efficiency. These initiatives are aligned with its long-term financial goals of increasing market share and profitability.

Risks

Key risks for Capital One include regulatory challenges, particularly related to the merger with Discover, and potential changes in consumer credit behavior due to economic conditions. The company is also exposed to competitive pressures in the financial services industry, which could impact its market share and profitability. Additionally, any adverse changes in interest rates could affect its net interest income.

Technical Analysis

Price Movements

Capital One's stock has experienced significant volatility, with a recent surge following the political shift in the U.S. administration. The stock reached a 52-week high of $198.30, reflecting positive market sentiment towards the merger with Discover and expectations of favorable regulatory changes .

Key Indicators

The stock's 50-day moving average is $153.47, while the 200-day moving average is $143.20, indicating a bullish trend. The Relative Strength Index (RSI) is at 77.57, suggesting the stock is overbought. The Moving Average Convergence Divergence (MACD) shows a positive trend, supporting the bullish outlook .

Support and Resistance Levels

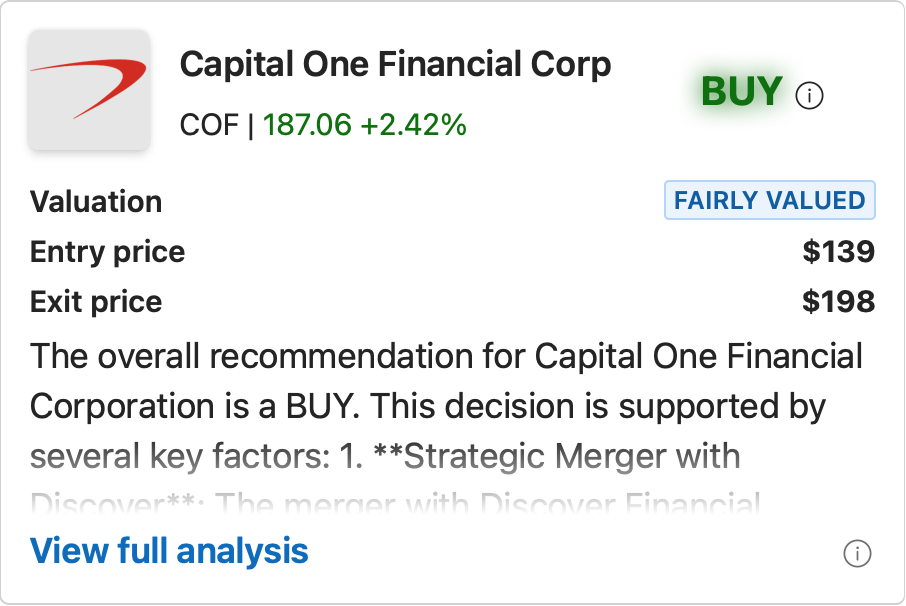

Key support levels are identified at $139 and $153, with resistance at $198, the recent high. These levels provide potential entry and exit points for investors .

Investment Recommendation

Valuation Insights

Capital One's current P/E ratio is 17.49, with a market capitalization of approximately $70.66 billion. The stock appears to be fairly valued compared to its peers, with room for appreciation if the merger with Discover proceeds smoothly. The dividend yield of 1.3% provides additional value to investors.

Short-term Outlook (3 to 6 months)

Given the current market conditions, Capital One is expected to benefit from a bullish market environment, strong financial performance, and positive momentum from the merger news. The stock is likely to rise, making it a BUY recommendation for the short term. This assessment is based on positive market conditions, strong financials, and favorable valuation metrics .

Long-term Outlook (3+ years)

Over the long term, Capital One is well-positioned for growth due to its strategic investments in technology and the potential synergies from the Discover merger. The company's strong fundamentals, competitive positioning, and growth prospects support a BUY recommendation for long-term investors. This recommendation considers the company's robust financial health, strategic initiatives, and market opportunities .

Exciting news! Charly’s stock rating engine is launching soon. Make sure to follow us on Twitter so you don’t miss the big reveal! https://x.com/charly___AI

Disclaimer: The information provided in this analysis is for informational purposes only and should not be considered financial or investment advice. Investors are encouraged to perform their own research and consult with a financial advisor before making any investment decisions.