Charly AI predicted the decline of Walgreens Stock (WBA)

On January 21, 2025, the Walgreens (WBA) stock experienced a decline of 13.54%. This drop followed news that the U.S. Department of Justice (DOJ) had filed a lawsuit against Walgreens on January 17, 2025. The lawsuit, filed in the U.S. District Court for the Northern District of Illinois, alleged that Walgreens knowingly filled millions of unlawful prescriptions for controlled substances, including opioids, in violation of the Controlled Substances Act and the False Claims Act. Walgreens responded on January 18, 2025, defending its pharmacists and challenging the DOJ’s allegations. However, the market reacted negatively, resulting in a sell-off that caused the stock’s significant decline.

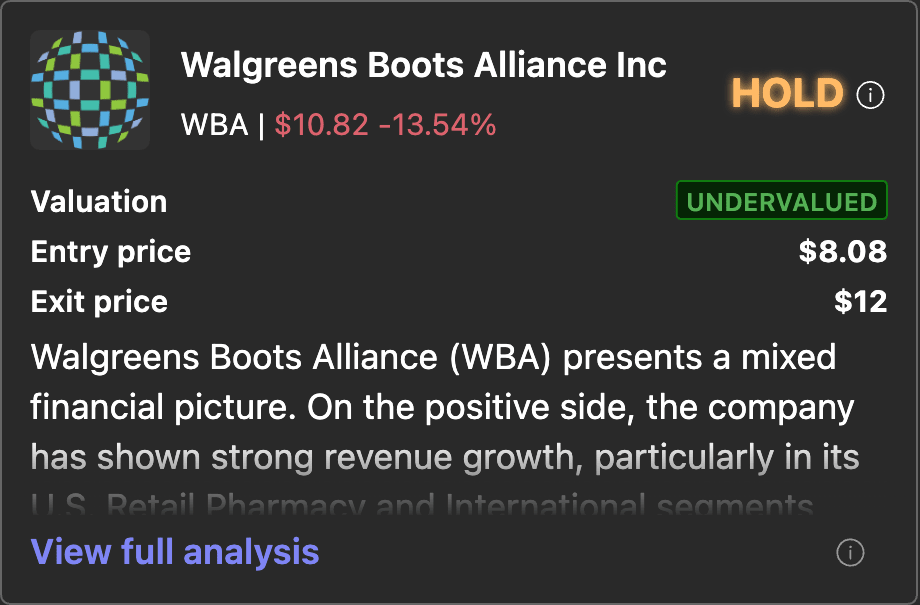

If you were a user of Charly AI, you might have seen this coming. Our AI had already analyzed the latest earnings, SEC filings, and stock data, ultimately concluding that investors should HOLD the stock rather than buy it, despite a strong quarter. The stock had surged 26% post-earnings on January 10, 2025, reflecting market optimism. However, Charly AI was not convinced that the strong earnings justified an overall BUY recommendation.

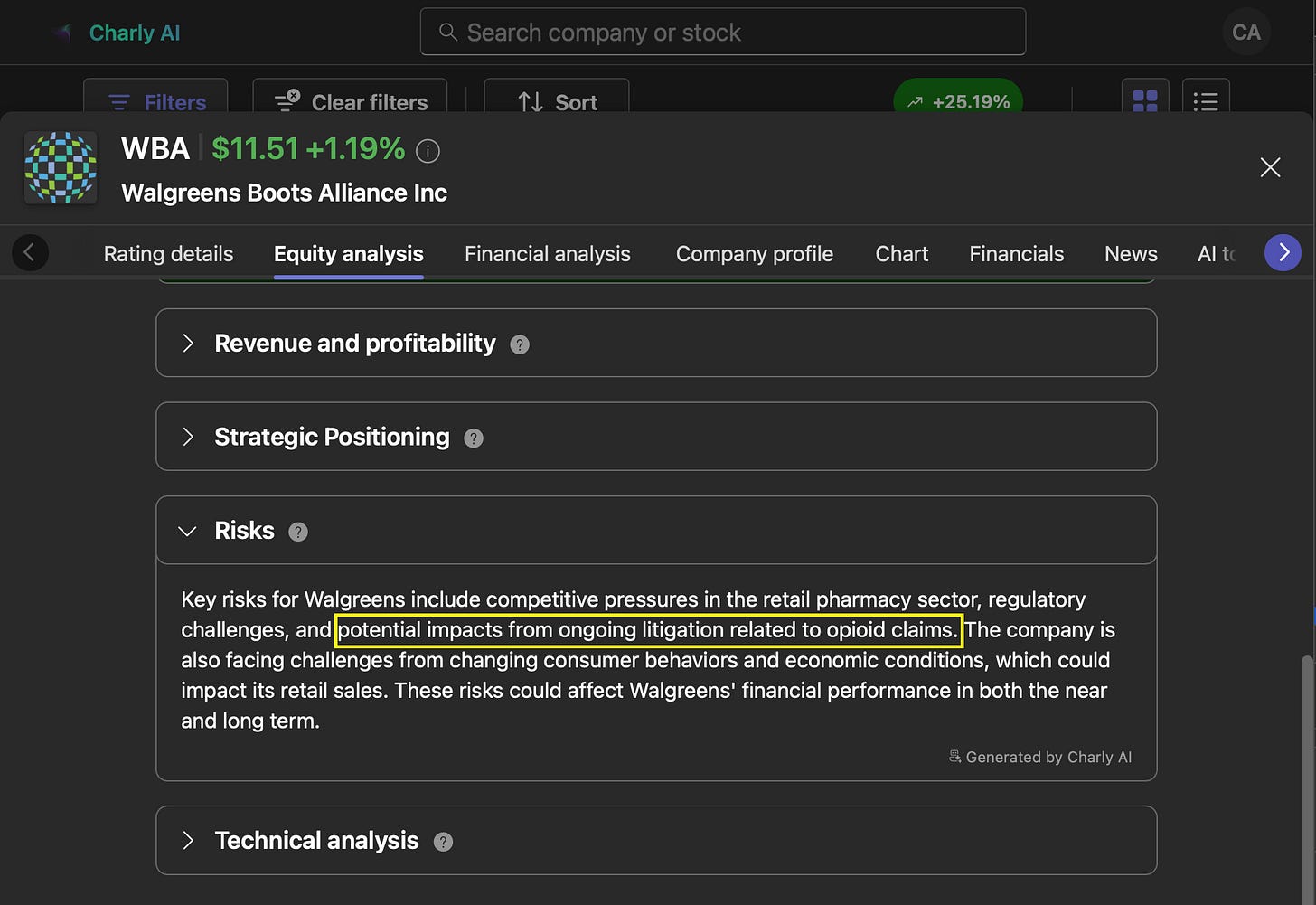

As shown in the screenshot below, Charly AI highlighted opioid litigation as one of the potential risks in its equity analysis report generated on January 10, 2025.

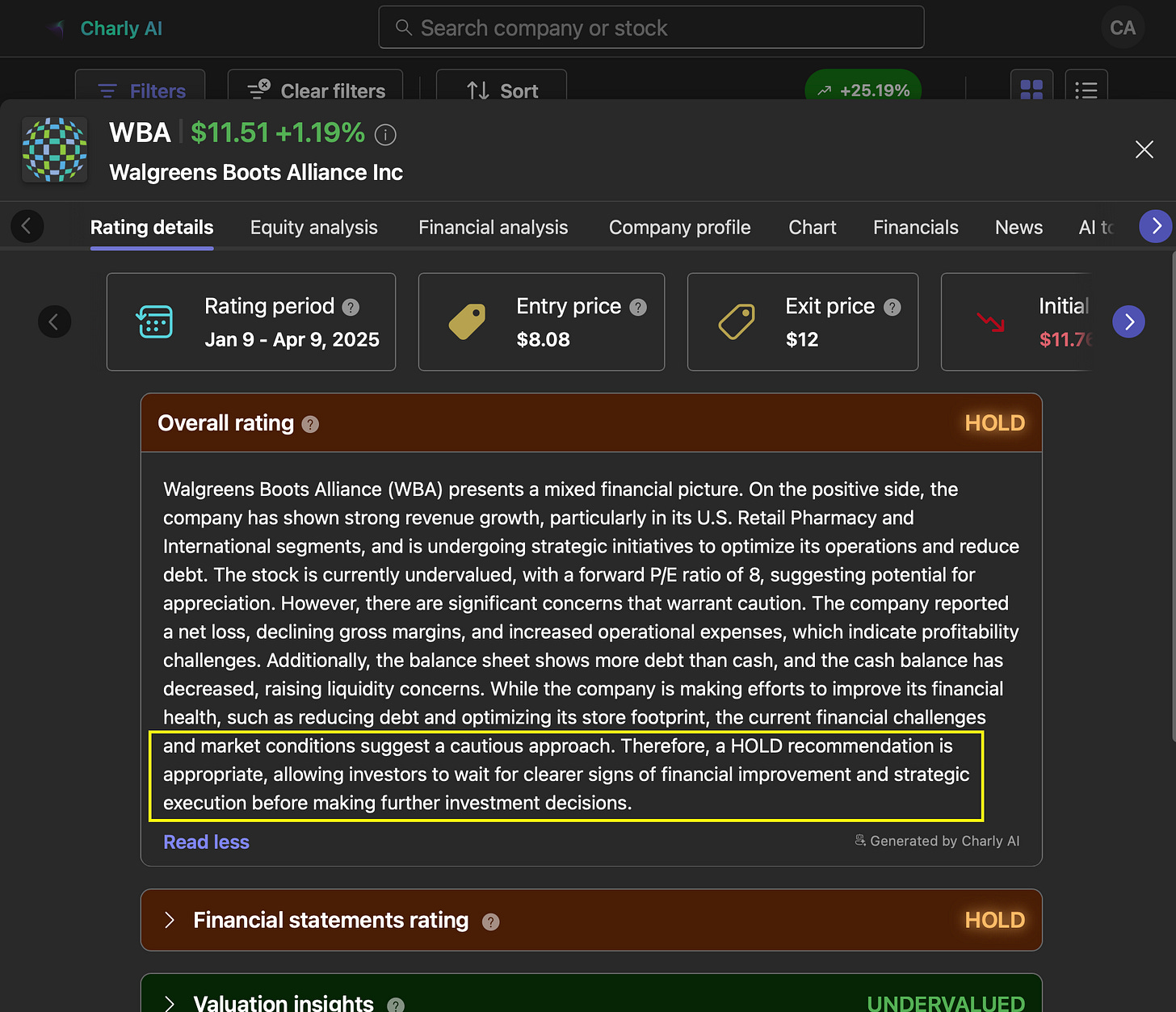

Despite a strong quarter, the AI rated the stock as a HOLD due to the opioid litigation risk and other financial challenges the company was facing, with the following comment:

While the company is making efforts to improve its financial health, such as reducing debt and optimizing its store footprint, the current financial challenges and market conditions suggest a cautious approach. Therefore, a HOLD recommendation is appropriate, allowing investors to wait for clearer signs of financial improvement and strategic execution before making further investment decisions.

As a user of the platform, would I buy the stock after this steep decline? My short answer is NO, not yet. My long answer is that I will continue to monitor both the stock and the company for the following reasons:

Wait to see the impact of the opioid litigation on the company’s financials.

Wait to see whether cost-cutting measures and store closures lead to improved profitability.

Monitor growth in the healthcare segment, and stabilization of pharmacy margins.

I will consider entering a position in this stock if the price drops below the $8 entry price suggested by Charly AI or if any of the reasons mentioned above begin to materialize.

If you enjoyed this writing feel free to leave a comment. My name is Yaovi Kwasi Founder and CTO of Charly AI. Charly AI was born from my struggle to cut through market noise and pinpoint winning stocks—a tool I wish I’d had earlier. It wasn’t until my portfolio crossed the seven-figure threshold that the weight of informed decision-making truly hit home. Drawing on my background architecting AI systems at Microsoft, I engineered a solution that thinks like a hedge fund analyst, processes data like a supercomputer, and turns complex market patterns into actionable insights for building serious wealth.

Checkout Charly AI at https://www.askcharly.ai