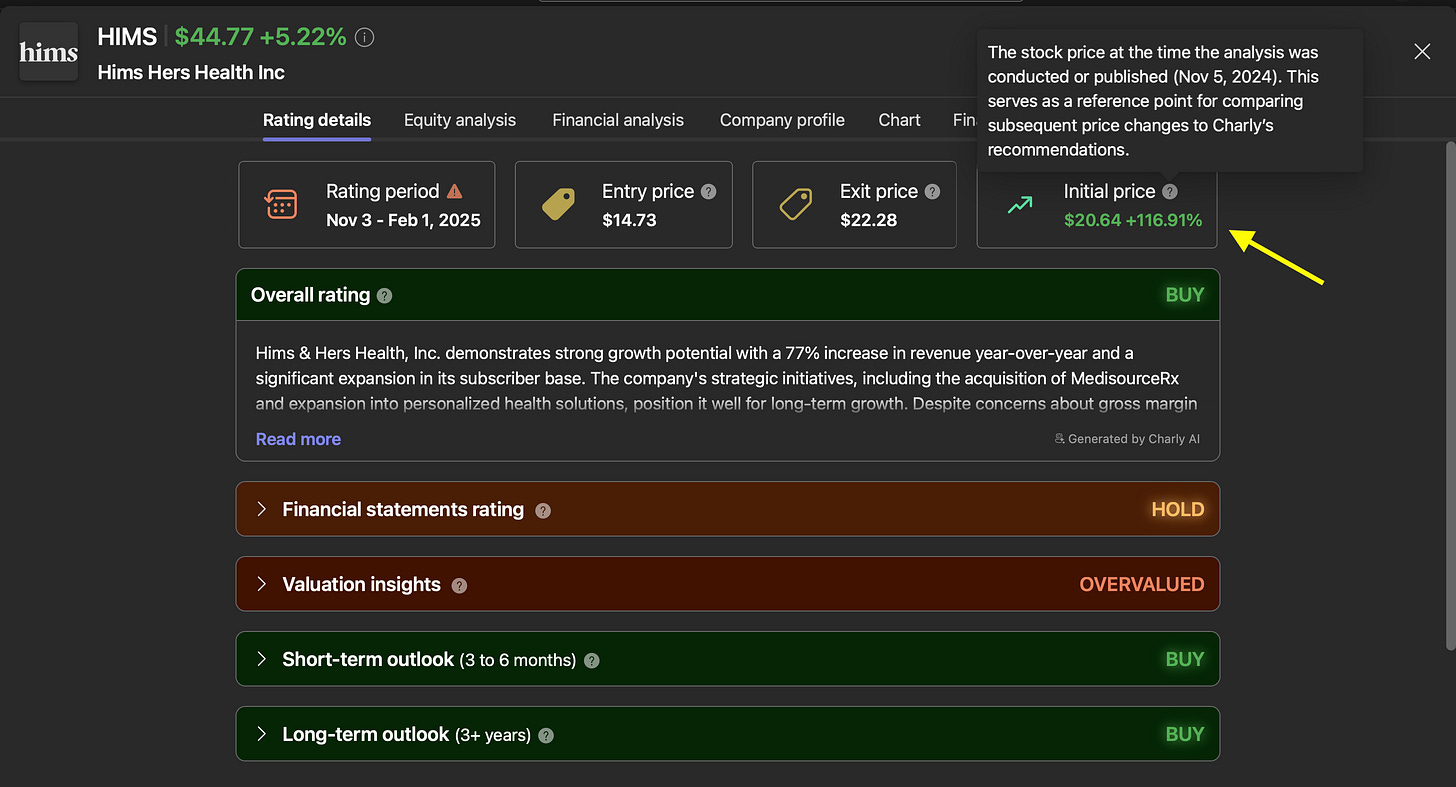

Charly AI rated this stock a BUY, 3 months ago. Now it is up 116%

This newsletter has now moved to https://www.askcharly.ai/alpha

The Company

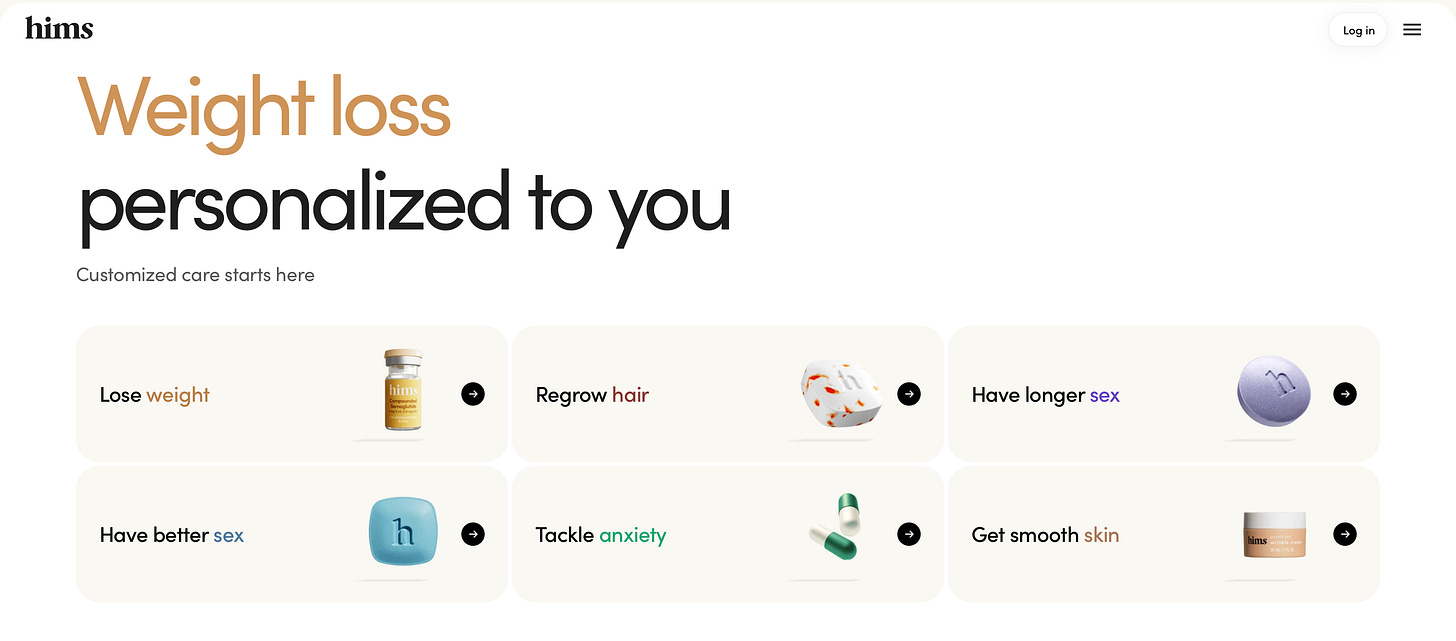

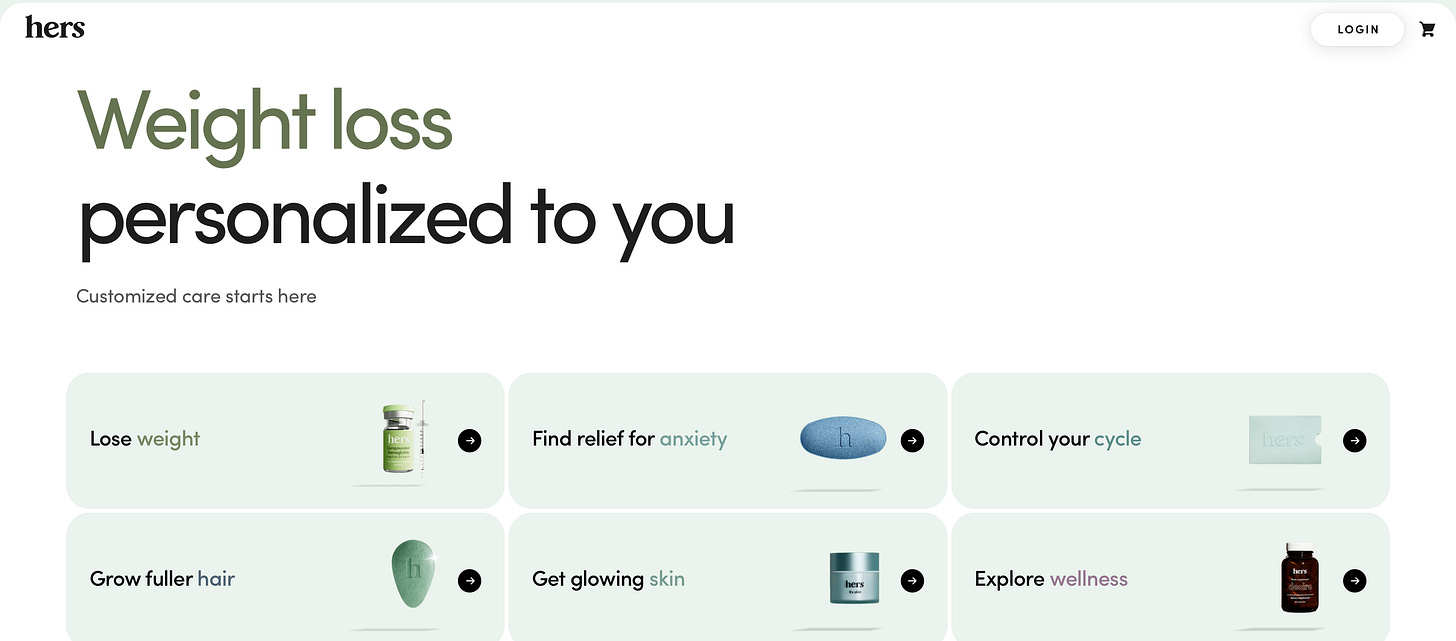

Hims & Hers Health Inc. (HIMS) is a telehealth company started in 2017 and based in San Francisco, California. It uses a direct-to-consumer online platform (website and app) to connect customers with licensed doctors and healthcare providers, mostly in the U.S. but also in other countries. They offer prescription and non-prescription products for general wellness, sexual health, skincare, hair care, and mental health.

Originally, the company focused on men’s health, selling treatments for issues like erectile dysfunction and hair loss. In 2018, they expanded with Hers, a brand for women’s health that provides services like birth control and menopause support. Hims & Hers uses a subscription service to send personalized medications and wellness products directly to customers, skipping traditional insurance to keep costs low and make things convenient. They also sell products through online retailers like Amazon.com.

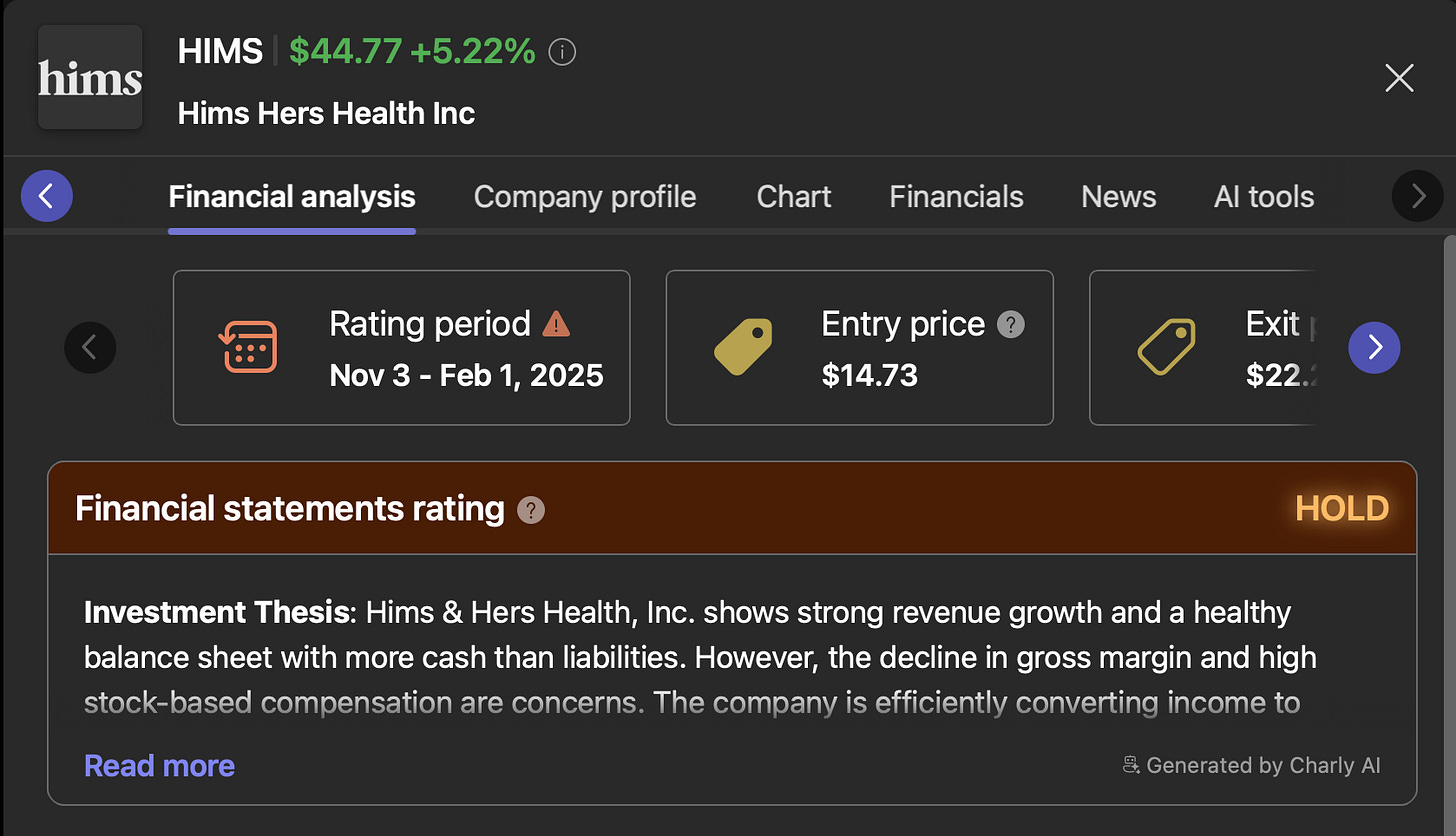

Charly AI rated the company a BUY after their Q3 earnings.

Revenue Growth & GLP-1

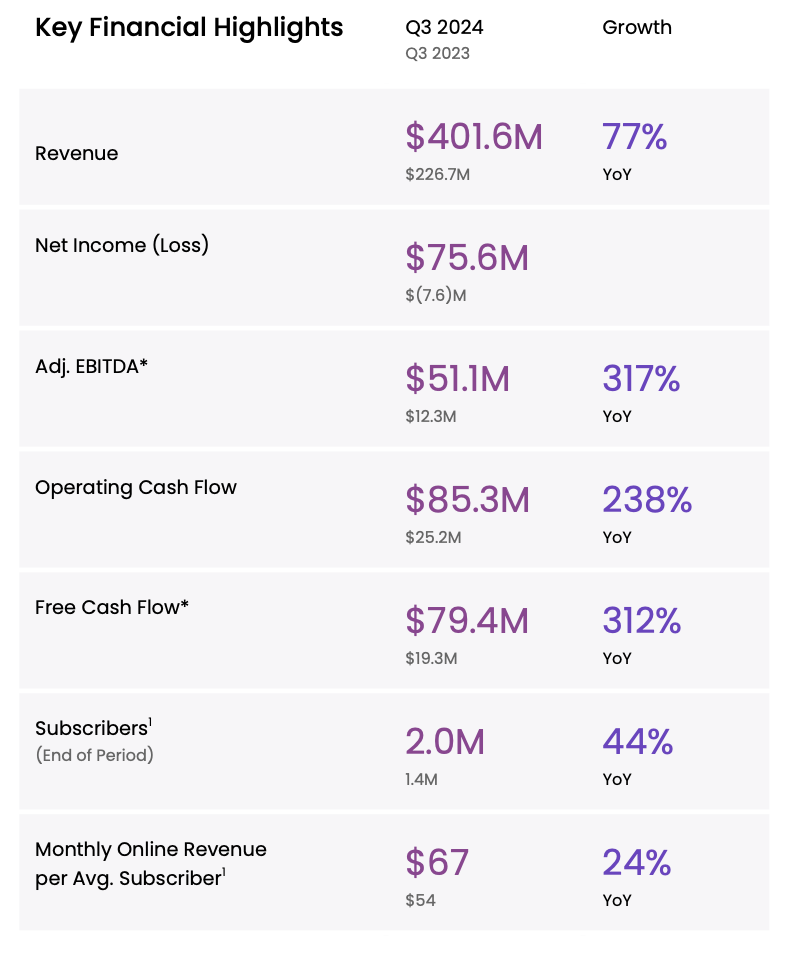

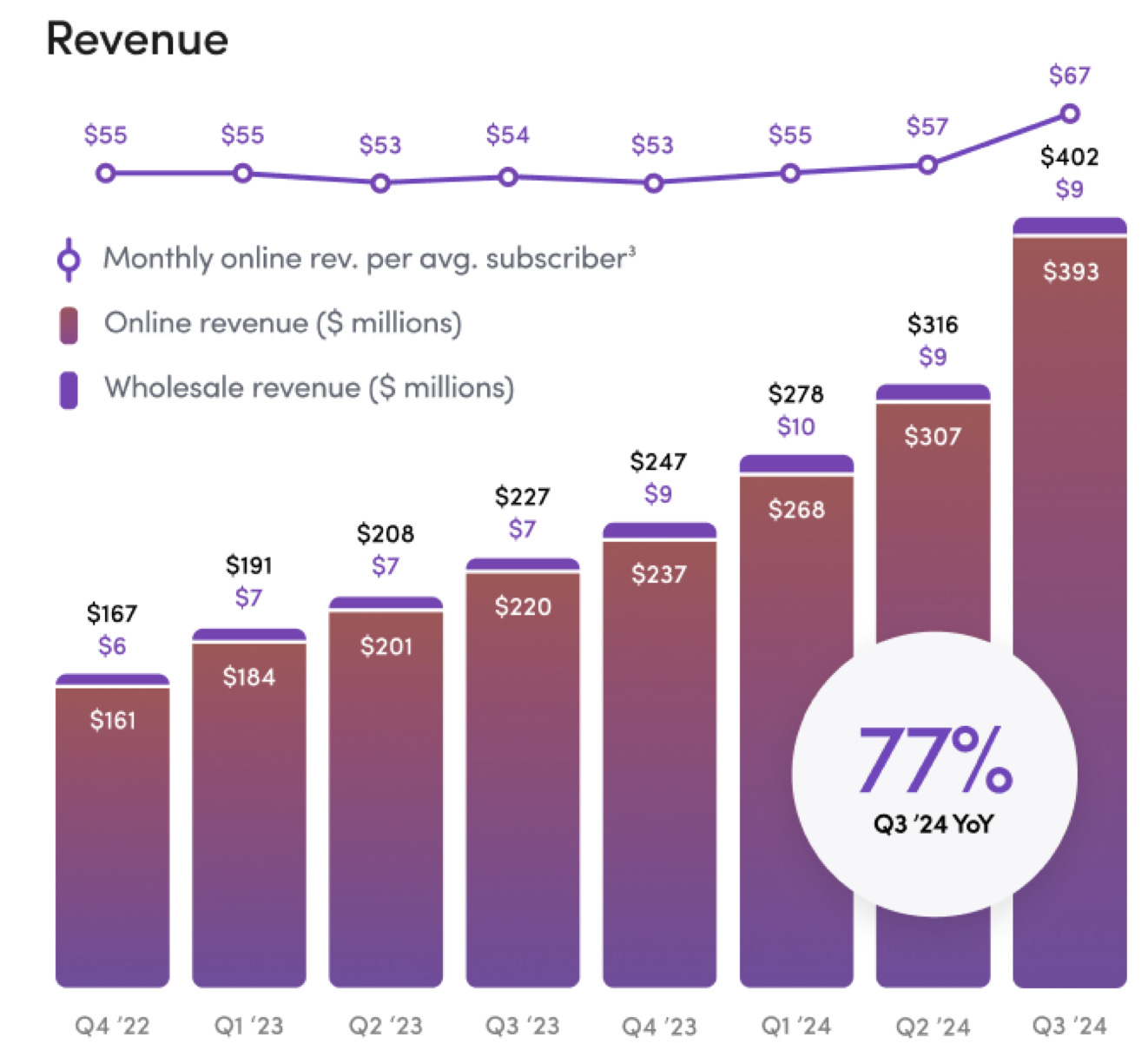

Hims & Hers increased its revenue by 77% year over year, reaching $401.6 million. This growth was driven by its online sales and a 44% increase in its subscriber base, which now exceeds two million subscribers. As of May 2024, the company also began offering GLP-1 medications for weight loss.

Other major pharmaceutical companies—such as Novo Nordisk, Eli Lilly, AstraZeneca, and Sanofi—have been offering GLP-1 drugs in the U.S. as well. Demand has skyrocketed because nearly 73.6% of U.S. adults aged 20+ are classified as overweight (2017–2018 data). This surge led to shortages of some branded versions of the drug.

To address these shortages, the U.S. Food and Drug Administration (FDA) allows compounding pharmacies to produce certain medications when commercial supplies run low. This enables companies like Hims & Hers to provide less expensive, compounded GLP-1 treatments when branded drugs are scarce. While it’s unclear how much these drugs boosted the company’s revenue, they likely played a role in its recent success.

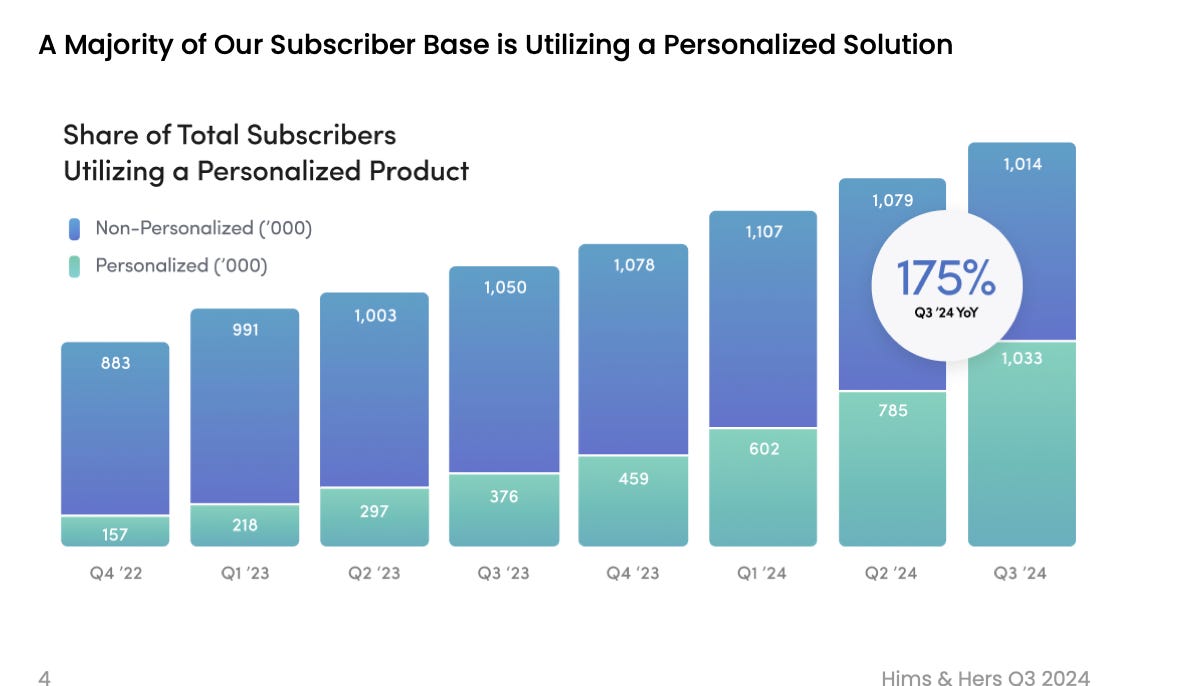

Personalized products

In addition to GLP-1s, the company is strengthening its relationships with subscribers by offering personalized products, which in turn increases customer loyalty. This subscriber segment has grown by 175% year over year. To support this growth and broaden its market reach, the company is also investing in technology to enhance customer experience and improve operational efficiency.

Acquisition of MedisourceRx

In September 2024, the company acquired MedisourceRx, a pharmacy that specializes in creating customized sterile medications for hospitals, clinics, and wellness centers. This acquisition will help the company increase production capacity and boost efficiency—especially for GLP-1 treatments—by utilizing automation. It also aligns with the company’s broader strategy to accelerate growth in the telehealth market.

Financial metrics and red flags

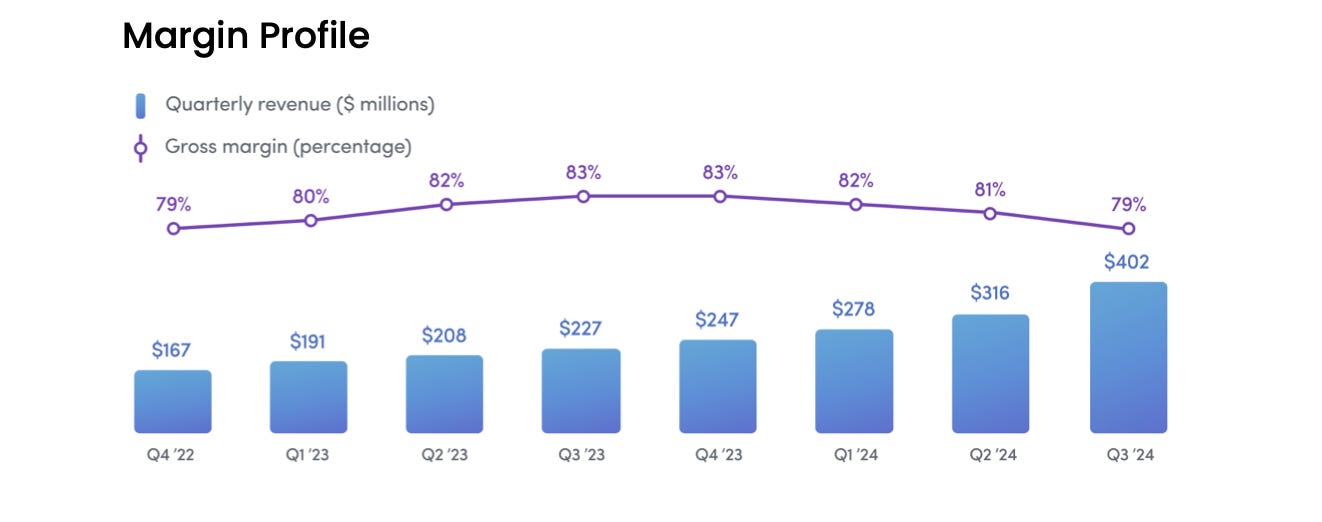

During the latest quarter, the company’s net income was $75.6 million, while its free cash flow reached $79.4 million. Because these figures are close, it suggests the company is managing its cash effectively. The company also reduced its marketing expenses from 51% of revenue in 2023 to 45% in 2024 while growing its subscriber base, which suggests better customer retention. However, Charly AI still rated the company’s financials as HOLD for the following reasons:

1. The company’s gross margin declined to 79%, slightly lower than in previous quarters, due to growing its weight-loss specialty segment, which initially operates at lower margins.

The company’s Inventory levels increased slightly, potentially signaling inefficiencies or overstocking.

Hims & Hers Stock-based compensation was high relative to net income (33% of net income), which could lead to shareholder dilution.

Risks

1. The FDA currently allows Hims & Hers to sell GLP-1 medications because of a shortage, but this permission could be revoked once the shortage is resolved—a significant risk for the company, especially since it acquired MedisourceRx to improve its GLP-1 offerings.

2. Compounded GLP-1 medications, which are cheaper options offered by companies like Hims & Hers, are not FDA-approved. This means their safety, effectiveness, and quality have not been evaluated by the agency. The FDA has received reports of adverse effects from these compounded drugs, and if more people experience problems, the agency might revoke the sales permit or compounded GLP-1 might face a class-action lawsuit.

3. Lastly, competition from other telehealth and pharmaceutical companies could further squeeze Hims & Hers’ profit margins.

My investment thesis

Although much of this article focuses on their GLP-1 offering, it’s important to note that the company provides a wide range of health products, so it isn’t only dependent on weight loss drugs. Based on the revenue growth data below, we estimate that GLP-1 drugs contribute about 12 to 16 percent of total revenue, since they only started offering them in May 2024 (Q2). While this is a noticeable contribution, it still represents a small part of their overall revenue. The company is also prepared to sell the branded, more expensive FDA-approved drugs from its competitors if the FDA revokes its compounding permission for their current GLP-1 products.

The American Journal of Public Health has estimated that nearly 45,000 deaths per year in the U.S. are linked to a lack of health insurance, and a Commonwealth Fund Biennial Health Insurance Survey found that about 43% of working-age adults were underinsured as of 2022. With the high cost of health insurance in the U.S, innovative solutions that bypass traditional insurers—like those from Hims & Hers—could shape the future of affordable healthcare.

Even though the stock was overvalued when Charly AI first rated it, I still took a position in it. Since then, the stock has more than doubled. I believe there is still plenty of room for growth, especially if the company continues to lower its marketing expenses while increasing its subscribers. I plan to keep a close eye on the stock and gradually add to my position, particularly if the price pulls back or if these metrics improve.

Don’t forget to join Charly AI for more detailed analysis on Hims & Hers.