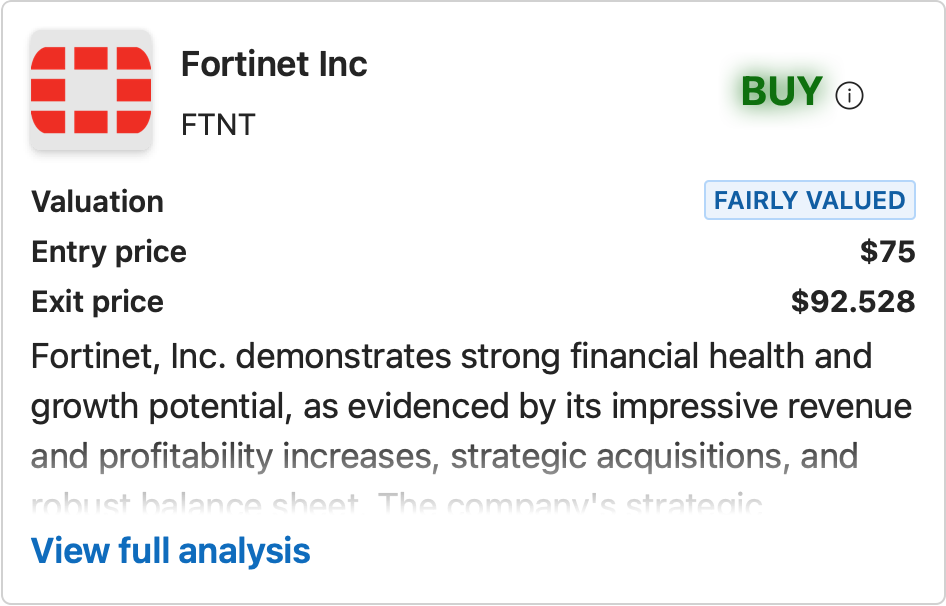

Charly rates this stock 'BUY' Now or Cry Later

Fortinet, Inc. has demonstrated strong financial performance in the third quarter of 2024, with significant growth in revenue and profitability. The company reported a 13% increase in total revenue, driven by a 19% growth in service revenue and a return to growth in product revenue. Notably, Fortinet achieved record gross and operating margins, with operating margin increasing by 830 basis points to over 36%. The company has also been active in strategic acquisitions, such as Lacework and Next DLP, which have contributed to its revenue and margin growth. Market sentiment is positive, as reflected in the stock's performance, which has seen a significant rise following the earnings report.

Fundamental Analysis

Revenue and Profitability

Fortinet's revenue for the third quarter of 2024 was $1.51 billion, a 13% increase from the same period last year. This growth was primarily driven by a 19% increase in service revenue, which accounted for 69% of total revenue, and a 2% increase in product revenue. The company's gross margin reached a record 83.2%, benefiting from higher product and service margins and a favorable revenue mix shift towards higher-margin services. Operating income also saw a substantial increase, with operating margin reaching 36.1%. The acquisitions of Lacework and Next DLP have positively impacted Fortinet's financials, contributing to both revenue and margin improvements.

Strategic Positioning

Fortinet is strategically positioned to capitalize on the growing demand for cybersecurity solutions. The company is focusing on expanding its Unified SASE and security operations offerings, which have shown significant growth. Fortinet's investment in its proprietary ASIC technology and its single operating system, FortiOS, provides a competitive advantage by enhancing performance and reducing costs for customers. The company's strategic acquisitions, such as Lacework and Next DLP, are expected to further strengthen its market position and drive future growth.

Risks

Fortinet faces several risks, including intense competition in the cybersecurity market, potential supply chain disruptions, and geopolitical uncertainties. The company is also exposed to risks related to its reliance on third-party manufacturers and the potential for product defects or vulnerabilities. These risks could impact Fortinet's financial performance if not managed effectively.

Technical Analysis

Price Movements

Fortinet's stock has experienced significant volatility, with a notable increase in price following the Q3 earnings report. The stock reached a 52-week high of $92.528, reflecting positive market sentiment.

Key Indicators

The stock's 50-day moving average is $78.42, and the 200-day moving average is $68.08, indicating a strong upward trend. The RSI is 70.71, suggesting that the stock is approaching overbought territory, while the MACD shows a positive momentum.

Support and Resistance Levels

Key support levels are around $75, with resistance at the recent high of $92.528. These levels provide potential entry and exit points for investors.

Investment Recommendation

Valuation Insights

Fortinet's current P/E ratio is 46.25, with a market capitalization of approximately $70.4 billion. The stock appears to be fairly valued relative to its peers, given its strong growth prospects and market position.

Short-term Outlook (3 to 6 months)

The short-term outlook for Fortinet is positive, with strong market conditions, robust financial performance, and positive stock momentum. The stock is expected to rise, and a BUY recommendation is appropriate based on the positive criteria outweighing the negatives.

Long-term Outlook (3+ years)

Fortinet is well-positioned for long-term growth, with strong company fundamentals, strategic investments, and a competitive market position. The long-term outlook is positive, and a BUY recommendation is warranted, as the positive criteria outweigh the negatives.

Check out Fortinet's Q3 2024 financials — spoiler alert: Charly gave it a BUY rating! That’s a triple BUY rating for this stock, plus it’s still fairly valued. https://www.askcharly.ai/share/djqGR7pQPi

Exciting news! Charly’s stock rating engine is launching soon. Make sure to follow us on Twitter so you don’t miss the big reveal! https://x.com/charly___AI

Disclaimer: The information provided in this analysis is for informational purposes only and should not be considered financial or investment advice. Investors are encouraged to perform their own research and consult with a financial advisor before making any investment decisions.