F5 Inc : The AI-Driven Stock Poised for a Big Breakout – Buy Now or Regret Later!

F5, Inc. has recently demonstrated strong financial performance, particularly in its fourth quarter of fiscal year 2024, where it reported record revenue and significant growth in its software segment. The company has been actively expanding its AI portfolio, which is expected to enhance its competitive positioning in the market. Recent news highlights F5's introduction of the AI Gateway, aimed at optimizing application interactions and reducing costs, which aligns with its strategic focus on AI-driven solutions. The market sentiment appears positive, as reflected in the stock's recent upward movement following strong earnings results and optimistic future guidance. F5's strategic initiatives, including its focus on AI and cloud services, position it well against competitors in the application security and delivery market.

Fundamental Analysis

Revenue and Profitability

F5's total net revenues for fiscal year 2024 were $2.82 billion, a slight increase from $2.81 billion in 2023. The growth was primarily driven by a 4.4% increase in service revenues, offsetting a 4.6% decline in product revenues. The decline in product revenues was due to decreased systems sales, although software revenues saw a 10.8% increase, reflecting a shift towards subscription-based models. Gross margins remained strong at 80.2%, up from 78.9% in the previous year, indicating effective cost management and a favorable sales mix. Operating expenses decreased by 8.4% due to restructuring efforts, leading to a 39.3% increase in income from operations. The company's focus on software and cloud services is expected to drive long-term profitability, although the transition from hardware sales may pose short-term challenges.

Strategic Positioning

F5 is strategically investing in AI and cloud-based solutions, as evidenced by its recent product launches like the AI Gateway. These initiatives are designed to enhance its application security and delivery capabilities, supporting its goal of becoming a leader in the multicloud environment. The company's restructuring efforts, including workforce reductions, aim to optimize operations and improve efficiency, which should support its financial goals by reducing costs and increasing margins. In the long term, these strategies are expected to strengthen F5's market position and drive sustainable growth.

Risks

Key risks for F5 include competitive pressures from other technology companies, potential regulatory challenges related to data security and privacy, and geopolitical risks that could impact its global operations. The company's reliance on a few large customers for a significant portion of its revenue also poses a risk. These factors could affect F5's financial performance by increasing costs or reducing revenue opportunities. However, F5's proactive approach to innovation and strategic investments in AI and cloud services may mitigate some of these risks.

Technical Analysis

Price Movements

F5's stock has shown significant volatility over the past year, with a notable increase following its strong Q4 earnings report. The stock reached a 52-week high of $250.46, reflecting positive market sentiment and investor confidence in the company's growth prospects.

Key Indicators

The stock's 50-day moving average is $225.07, while the 200-day moving average is $193.11, indicating a bullish trend. The Relative Strength Index (RSI) is at 78.22, suggesting the stock is overbought, which could lead to a short-term pullback. The MACD is positive, reinforcing the bullish momentum.

Support and Resistance Levels

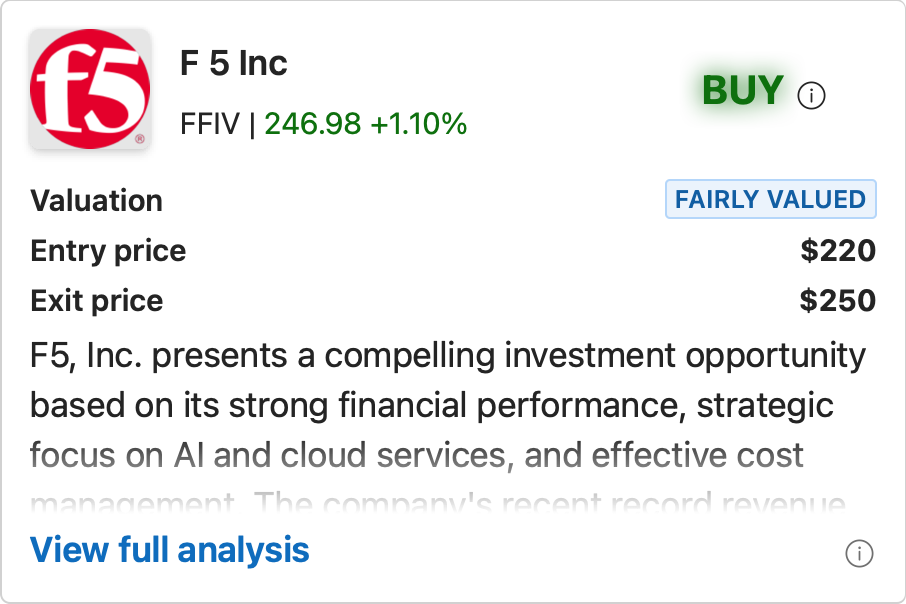

Key support levels are around $220, with resistance at the recent high of $250. These levels suggest potential entry and exit points for investors, with the stock likely to face resistance as it approaches its 52-week high.

Investment Recommendation

Valuation Insights

F5's current P/E ratio is 25.58, with a market capitalization of $14.32 billion. The stock appears fairly valued relative to its peers, given its strong growth prospects and strategic focus on AI and cloud services. However, the high P/E ratio suggests limited upside potential in the short term.

Short-term Outlook (3 to 6 months)

The short-term outlook for F5 is positive, driven by strong market conditions, robust financial performance, and bullish stock momentum. The company's strategic investments in AI and cloud services are expected to support continued growth. Given these factors, a BUY recommendation is appropriate, as the positive criteria outweigh the negatives.

Long-term Outlook (3+ years)

F5's long-term prospects are favorable, supported by strong company fundamentals, strategic investments in growth areas, and a solid competitive position. The company's focus on AI and cloud services aligns with industry trends, offering significant growth potential. A BUY recommendation is warranted, as the positive criteria outweigh the negatives, positioning F5 for long-term value creation.

Exciting news! Charly’s stock rating engine is launching soon. Make sure to follow us on Twitter so you don’t miss the big reveal! https://x.com/charly___AI

Disclaimer: The information provided in this analysis is for informational purposes only and should not be considered financial or investment advice. Investors are encouraged to perform their own research and consult with a financial advisor before making any investment decisions.