Get Rich… with Eggs Stock?

Buy Eggs, Get Rich? Kinda.

Today we are focusing on two stocks out of Charly AI's last week's picks, which is composed of 11 stocks with strong fundamentals, attractive valuations, and solid growth outlook. What makes the two we are covering today stand out? Beyond their financial strength, they operate in sectors that tend to hold steady—even thrive—during economic downturns.

The first stock Cal-Maine Foods (CALM) sits within the farm products industry, more specifically—eggs. It’s a textbook example of recession resilience. Demand is inelastic, production is fast, and pricing power holds firm. In short, with stable supply chains and growing global demand, you’ve got a long-term winner. The second one PriceSmart (PSMT) operates in the discount stores industry. Players here are built for tough times. With a low-cost model and essential product mix, they cater to price-sensitive consumers, maintaining profitability even as wallets tighten. When uncertainty rises, value becomes king—and discount stores deliver. Cheap wins, always.

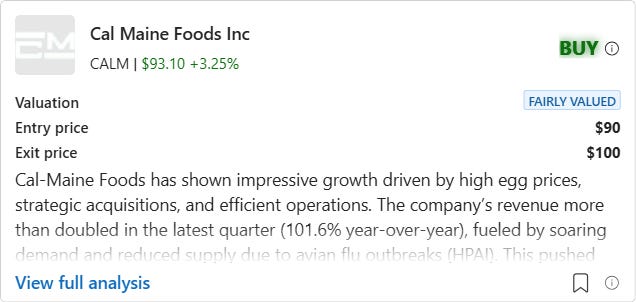

1. Cal-Maine Foods – CALM

CALM has shown impressive growth driven by high egg prices, strategic acquisitions, and efficient operations. The company’s revenue more than doubled in the latest quarter (101.6% year-over-year), fueled by soaring demand and reduced supply due to avian flu outbreaks (HPAI). This pushed gross margins to 50.5%, up from 31.1%, as higher selling prices offset lower feed costs. With $497.2 million in cash and no significant debt, Cal-Maine’s balance sheet is robust, allowing it to invest in cage-free production to meet regulatory trends and consumer preferences. These expansions, alongside recent acquisitions like ISE America, position the company to capture long-term market share despite risks like future HPAI disruptions or regulatory cost hikes.

While egg prices are volatile, CALM’s disciplined cost management and focus on high-margin specialty eggs (25.4% sales growth) add stability. Technical indicators like a rising 50-day moving average ($93.36) and positive MACD momentum suggest bullish sentiment, though resistance near $100 could test short-term gains. The trailing P/E of 4.46 highlights undervaluation based on current earnings, but the forward P/E (29.98) reflects expectations for sustained profitability. Legal risks and disease outbreaks remain concerns, but the company’s strong cash reserves and strategic investments mitigate these challenges.

Given Cal-Maine’s dominant market position, financial strength, and alignment with industry trends, the stock presents a compelling opportunity. Investors looking for exposure to a resilient agribusiness with growth potential should consider a BUY for both short-term gains and long-term growth, as the company’s fundamentals and strategic moves outweigh near-term risks.

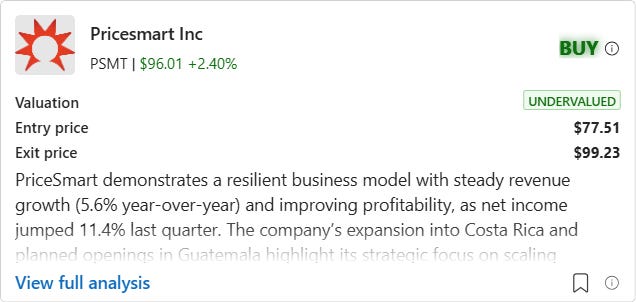

2. PriceSmart – PSMT

PSMT demonstrates a resilient business model with steady revenue growth (5.6% year-over-year) and improving profitability, as net income jumped 11.4% last quarter. The company’s expansion into Costa Rica and planned openings in Guatemala highlight its strategic focus on scaling operations in Central America, a region with growing consumer demand. Despite a slight dip in gross margins (15.6%, down 0.1%), PriceSmart maintains a strong balance sheet, holding more cash ($145.5 million) than debt ($107.1 million), which provides flexibility to navigate risks like potential tariff impacts or currency volatility. Its valuation also looks attractive, trading at a P/E ratio (19.99) below industry averages, suggesting room for upside as growth initiatives take hold.

While rising costs for technology investments and geopolitical uncertainties pose challenges, these are balanced by prudent management. The company’s effective tax rate improved (27.2%, down from 30.5%), boosting net income, and its focus on digital upgrades and membership programs (like Platinum Membership) should drive customer loyalty and long-term sales. Although capital expenditures are high, they reflect necessary investments in distribution networks and new clubs, which could enhance future revenue. Technical indicators like a bullish MACD and the stock trading above key moving averages signal positive momentum, aligning with strong fundamentals.

Given PSMT’s combination of growth potential, financial stability, and undervaluation relative to peers, the stock presents a compelling opportunity. Risks exist but appear manageable, and the company’s strategic investments position it well for both near-term gains and sustained growth. BUY for investors seeking exposure to a steadily expanding retailer with a solid track record and upside potential.