Insiders Are Loading Up on This Small Cap

Insider Buying + Drone Breakthrough = Sinclair Upside?

The rationale…

When evaluating a stock, most investors focus on financial performance, the management’s ability to execute, and the broader macro environment. But insider buying deserves a seat at that table too. Why? Because when executives put their own money into the business, it’s a strong vote of confidence in the company’s future. These are the people who know the business inside out—their actions often speak louder than earnings reports. While insider selling gets attention, it’s not always bearish. Execs sell for many personal reasons—diversification, taxes, or large life events. But when they’re buying? That’s usually a sign worth watching.

The insider signal…

Two weeks ago, when Trump started rolling out tariffs, Sinclair's (SBGI) Executive Chairman, David D. Smith, bought 443,258 shares in a series of open market purchases. On April 3rd, he bought 258,113 shares for ~$3.7 million at prices between $13.20 and $14.98, and on April 8 & 9, another 185,145 shares, taking his total spend for the month north of $6 million. Given Sinclair’s struggles in the past few years with the cord-cutting trend and sports media rights drama, this kind of conviction from the top is worth noting. In addition, Sinclair has become the first broadcast company granted FAA authorization to fly drones over people and moving vehicles for newsgathering — no waiver required. This milestone positions Sinclair at the forefront of drone journalism.

The company…

Sinclair, Inc. is a U.S.-based media company delivering content through both local television stations and digital platforms. The business is split into two core segments: Local Media and Tennis. The Local Media segment runs a portfolio of broadcast TV stations and original networks, offering free, over-the-air programming—including live local sports—and creates original and local news content. It also earns revenue by distributing its programming to multi-channel video providers in return for fixed contractual fees. Meanwhile, the Tennis segment revolves around the Tennis Channel, a cable network featuring premier tournament coverage, original sports programming, and lifestyle shows focused on the tennis world.

What Charly AI says…

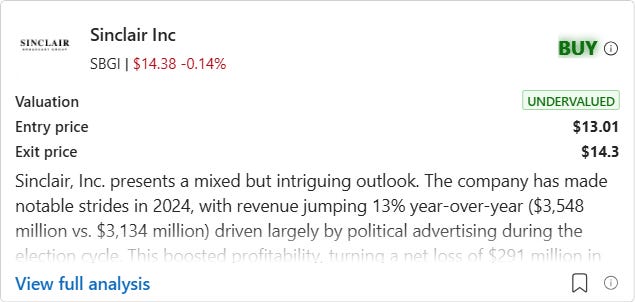

Figure 1. Charly AI rating of SBGI

Sinclair presents a mixed but intriguing outlook. The company has made notable strides in 2024, with revenue jumping 13% year-over-year ($3,548 million vs. $3,134 million) driven largely by political advertising during the election cycle. This boosted profitability, turning a net loss of $291 million in 2023 into a $310 million profit. Strategic moves like its media-for-equity initiative and investments in next-gen broadcast technology (ATSC 3.0) signal a push toward diversification and innovation, which could open new revenue streams in the long-term. However, challenges remain: core advertising dipped slightly due to political campaigns crowding out other ads, subscriber numbers are declining amid cord-cutting trends, and debt remains elevated at $4.1 billion—though stable cash flow ($697 million in reserves) helps mitigate this risk.

Technically, the stock appears undervalued with a low P/E ratio (3.10) and price-to-book ratio (1.64), suggesting potential upside. But short-term indicators like the bearish moving averages and negative MACD hint at continued volatility. While operating cash flow ($98 million) lagged net income ($319 million), raising questions about cash generation efficiency, the balance sheet improved with rising cash reserves and positive retained earnings. For investors with a 3+ year horizon, Sinclair’s strategic bets on digital transformation and undervaluation create a compelling case. A BUY for long-term investors who can stomach some near-term volatility. The company’s strategic shift toward tech-enabled growth and strengthening fundamentals suggests real upside for those willing to be patient. For short-term focused investors, it may be a HOLD, but the long-term opportunity far outweighs the current challenges for anyone with a higher risk appetite.