Is Charlie Munger “perfect company” still worth the buy?

Costco's Soaring Stock Price: Is It Still a Smart Buy Despite a Sky-High Valuation?

“I love everything about Costco. I'm a total addict and I'm never going to sell a share. The trouble with Costco is its 40 times PE (Price to Earnings) ratio, but except for that, it's a perfect damn company and it has a marvellous future.” Those were the late Charlie Munger’s words during The Daily Journal's annual shareholder meeting in January 2023. Since then, Costco’s stock price increased by 72% as of today, pushing its cost to 54 times its earnings, which is the highest of all retailers in the S&P 500, and even higher than NVIDIA’s (48 times earnings). At this price, is Costco still worth the buy?

Source: Yahoo Finance

Costo is a moat: profitable, with a competitive advantage in a resilient sector

Stock price aside, it is not difficult to prove that Costco is a good and well-managed company. In the last decade, Costco doubled its revenue and gross profit. The company has a hard-to-replicate business model, consisting of minimizing operating expenses by running simple warehouses with a limited selection of products stacked on pallets in large quantities. This provides Costco with better negotiation leverage with suppliers and helps in maintaining low working capital. Though Costco uses a membership model, its markup is very low, which explains its low gross margin (c.10%, about half of Walmart’s).

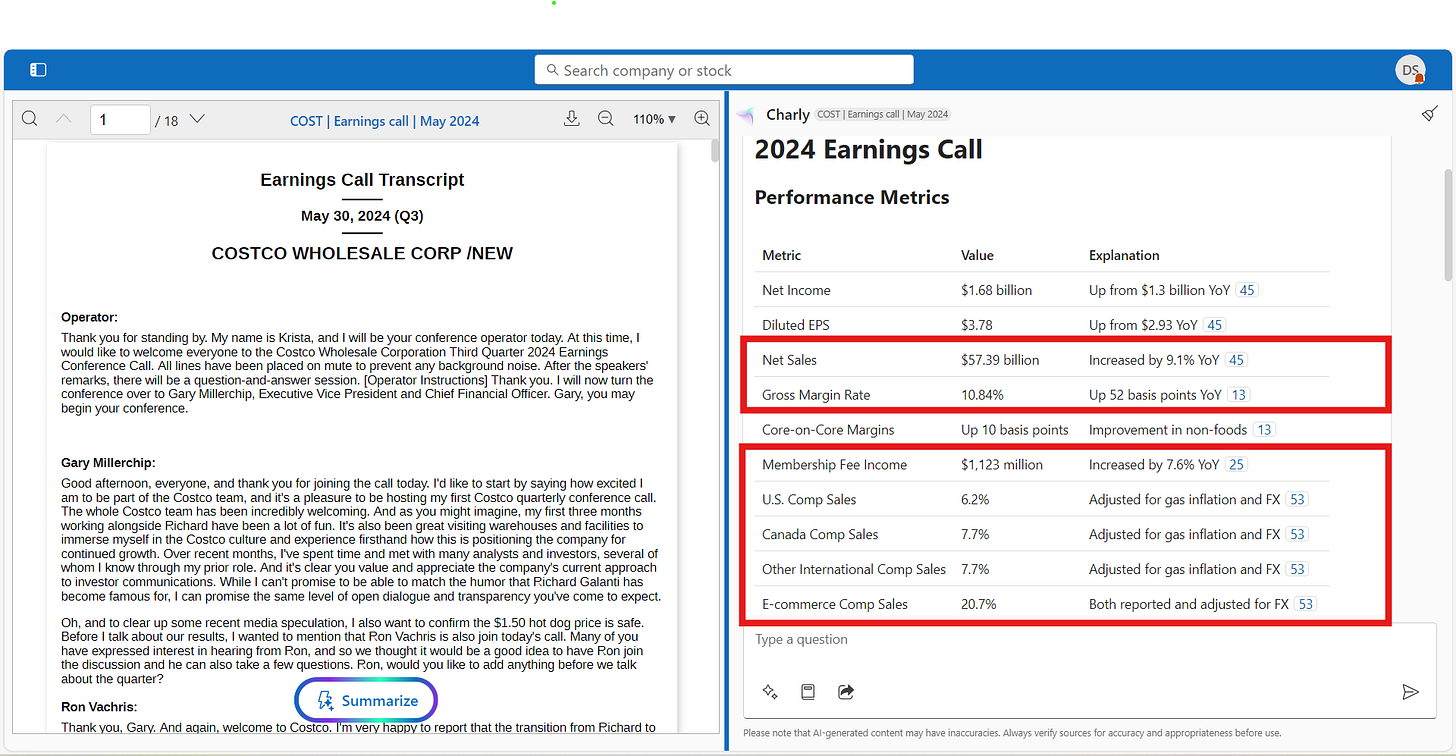

Costco’s current performance has also been outstanding, with its Q3 2024 revenue increasing by 9% and gross profit by 52 basis points year-over-year (YoY). Sales in warehouses grew at the same rate 7% in North America and internationally while online sales grew by 21% YoY.

Source: www.askcharly.ai

Costco’s current strategy is focused on expanding globally and leveraging technology to enhance its digital platform, member experience, and operational efficiency. BMO Capital Markets estimates that there is enough untapped potential in the U.S. for Costco to open clubs at the current pace of about 14 clubs a year for another 16 or more years. With Costco’s growing popularity abroad, the same could be assumed for international expansion. While the overall retail sector is heavily dependent on macroeconomic factors, Costco’s positioning as a bulk discounter insulates the company against economic downturns.

Source: www.askcharly.ai

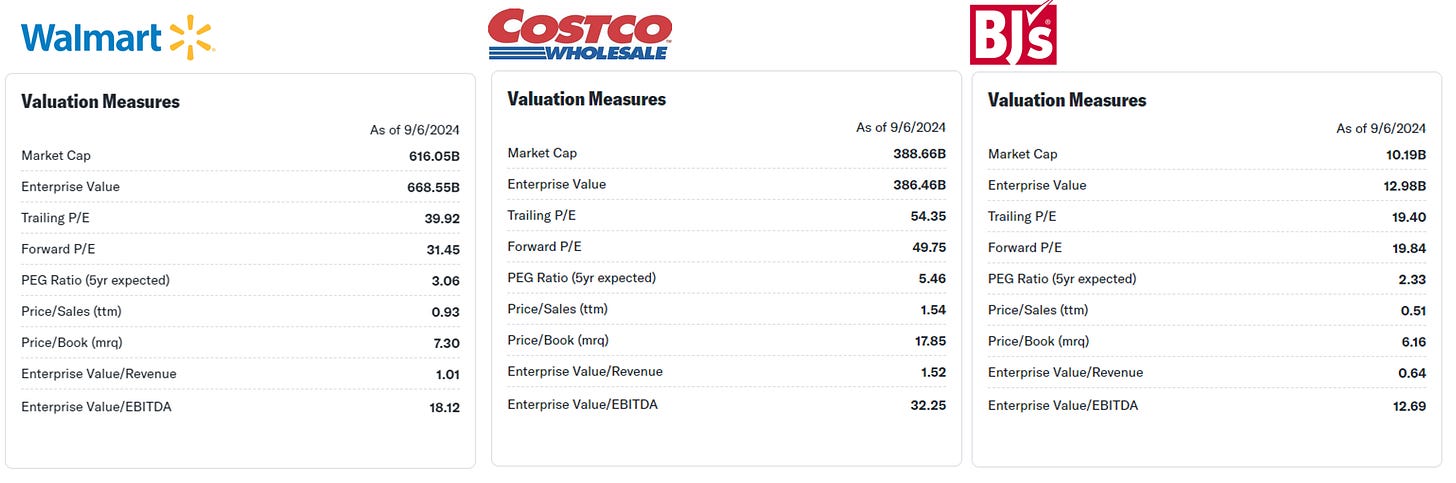

Costco is too expensive for value investors however BJ’s might be the perfect alternative

Similar to its PE ratio, all of Costco’s valuation metrics are higher than Walmart’s, which has twice its market size. If we are following Warren Buffett and Charlie Munger’s investment principle, which is to find “moat” companies and buy them at a fair price, Costco meets the moat criteria; however, its price is not fair. I believe Charlie Munger would have agreed with this conclusion, as he bought Costco stocks (187,180 shares worth $164m as of today) between 1999 and 2000 when its PE ratio was 37 times earnings. It is also worth mentioning that Berkshire Hathaway exited its stake in Costco in late 2020 after selling 4.3 million shares.

An alternative to Costco could be BJ’s, as the company plays in the same sector, has a similar model to Costco, and has a 19 times PE ratio vs Costco’s 54. Though BJ’s remains in its infancy, the company is currently mainly focused on the East Coast of the U.S. In its last quarter, BJ’s generated a 16% gross margin, which is higher than Costco’s 11%. However, BJ’s revenue grew at a slower rate YoY compared to Costco (5% vs 9%).

Source: Yahoo Finance

Please let me know if you want a deep dive analysis of BJ’s and don’t forget to share your thoughts on Costco.

Below are the links to Costco and BJ’s latest Earning calls summary, and last Year Daily Journal annual shareholder’s meeting in which Charly Munger commented on Costco.

Costo Earnings Call Summary - May 30, 2024

BJ’s Earnings Call Summary - August 22, 2024

The Daily Journal annual shareholder’s meeting – February 2023

Disclaimer: The information provided in this analysis is for informational purposes only and should not be considered financial or investment advice. Investors are encouraged to perform their own research and consult with a financial advisor before making any investment decisions.