Is DeepSeek a signal of the top for NVIDIA? Top stocks to watch as AI race with China heats up.

This newsletter has now moved to https://www.askcharly.ai/alpha

A quick timeline recap

DeepSeek R1

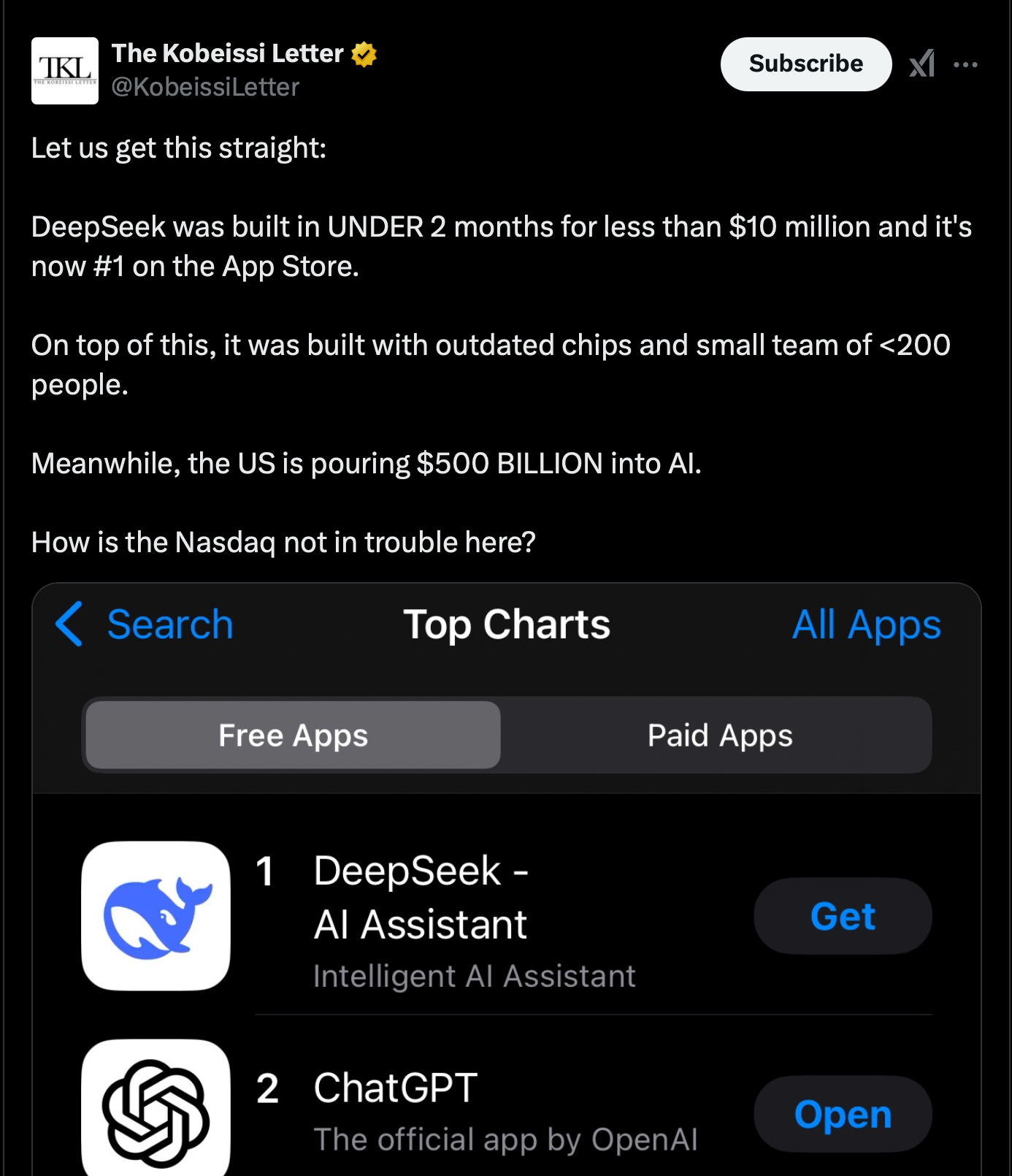

On January 20, 2025, DeepSeek, the China-based AI lab, unveiled DeepSeek R1, their state-of-the-art reasoning model designed to rival OpenAI’s O1 series. The release of R1 sent shockwaves through the U.S. AI industry, quickly becoming the focal point of discussions. The open-sourcing of the model, along with its weights, marked a pivotal moment for the industry. Key details that positioned R1 at the center of attention include:

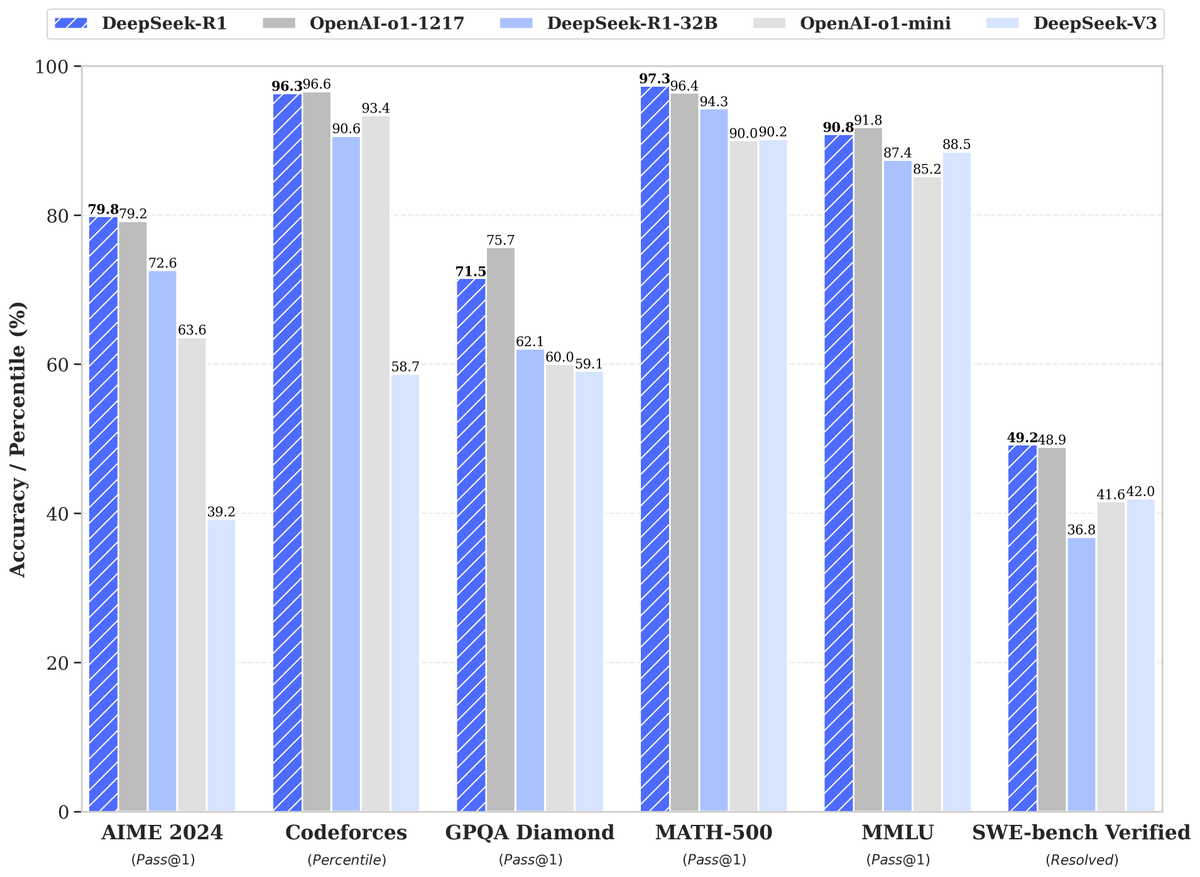

The R1 reasoning model not only matches but even surpasses OpenAI’s O1 series model on multiple industry benchmarks, showcasing its superior performance and capabilities.

The cost to train R1 is estimated at $5.5 million, a stark contrast to the $100 million budget reportedly required for OpenAI’s O1 models. If you want to know exactly how DeepSeek achieved this checkout this X thread.

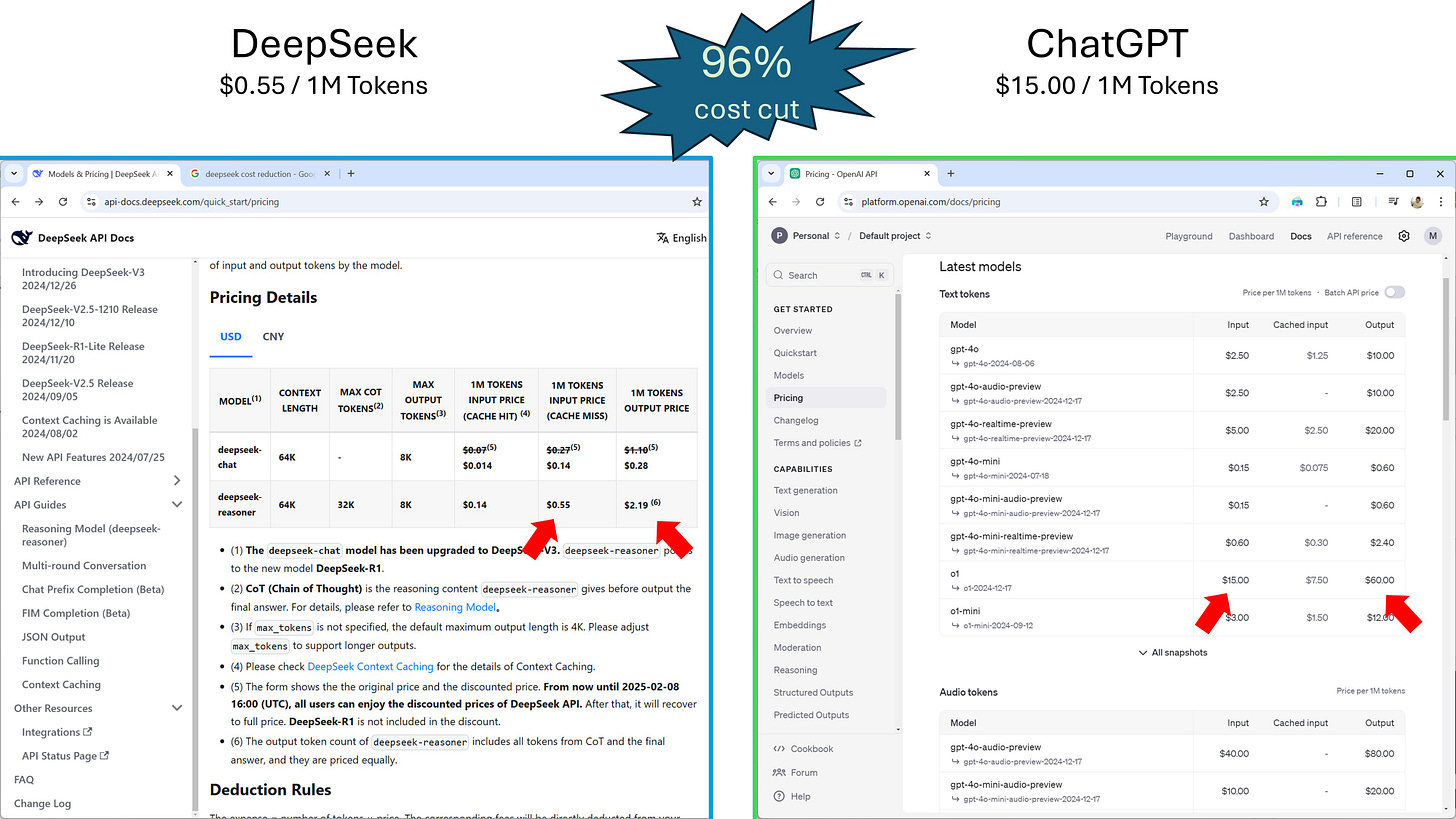

The APIs offered directly by DeepSeek for R1 are priced 96% lower than OpenAI’s O1 APIs. Additionally, users have the option to run either the full or distilled version of R1 on their own hardware or by renting compute resources from third-party providers.

Stargate Project

On January 21, 2025, OpenAI, SoftBank, Oracle, and MGX, alongside President Donald Trump, announced a $500 billion artificial intelligence (AI) infrastructure initiative known as the Stargate Project. The ambitious effort aims to build the largest AI infrastructure network in history, with an initial investment of $100 billion.

• SoftBank will oversee financial management.

• OpenAI will take on operational responsibilities and will be the exclusive user of the data centers built under the project.

• Oracle will contribute its expertise in data center infrastructure and computing systems.

• Additional partners, including Microsoft, NVIDIA, and Arm, will provide critical technological support.

The announcement stirred up drama on social media. On Twitter/X, Elon Musk claimed that SoftBank might not actually have the capital to back the initiative, though he suggested that Microsoft likely has the resources to expand its own Azure infrastructure. Meanwhile, Satya Nadella added to the tension with a subtle dig at Sam Altman, hinting that Altman might be overhyping AI.

Tensions between OpenAI and Microsoft have become increasingly evident. A key aspect of their revised partnership agreement, announced on January 21, 2025, is Microsoft’s Right of First Refusal (ROFR). This clause grants Microsoft priority in hosting OpenAI’s AI workloads on its Azure cloud infrastructure but allows OpenAI to explore alternative cloud providers if Microsoft cannot meet its computational needs.

This revision reflects the growing strain caused by OpenAI’s escalating computational demands, which Microsoft’s Azure infrastructure has struggled to fully support. These limitations have reportedly led to delays in OpenAI’s product releases, highlighting the challenges in maintaining their rapid pace of innovation within the constraints of a single cloud provider.

OpenAI Operator

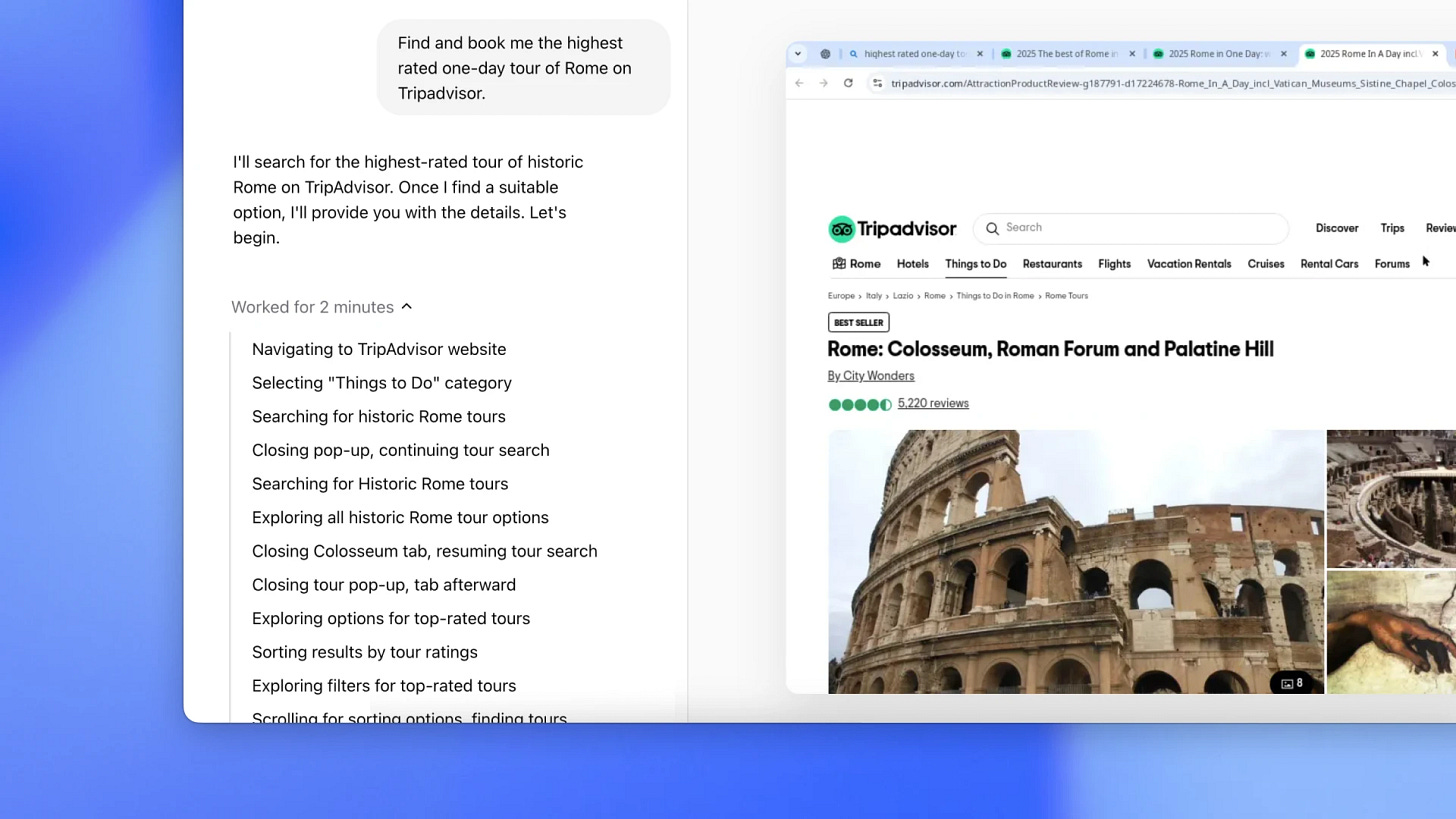

On January 23, 2025, OpenAI announced “Operator,” a cutting-edge AI agent designed to handle repetitive tasks autonomously. Operator features a built-in browser, enabling it to perform tasks such as ordering groceries, booking trips, and more on behalf of users.

Speculation is growing about ongoing partnerships between OpenAI and various service companies, which may integrate with Operator to streamline basic tasks and enhance user convenience. If confirmed, these collaborations could position Operator as a key player in the automation of everyday tasks.

As you can see in the screenshot below, Operator didn’t gain as much traction amidst the DeepSeek frenzy.

DeepSeek Fallout

Where do we go from here, and how is this going to affect the AI fueled stock market growth?

NVIDIA - The elephant in the room

Let me cut to the chase. Open-source models are not a bullish signal for NVIDIA, especially in a fragmented AI market with razor-thin margins. Anyone—literally anyone—can run a powerful open-source model like R1 locally or in the cloud. For models like R1, inference matters far more than training. This isn’t a winner-takes-all market anymore, and there’s no moat.

The training algorithms and efficiency gains DeepSeek has uncovered will define how reasoning models are built moving forward. Every AI lab is scrambling to capitalize on these breakthroughs. The genie’s out of the bottle—overspending on infrastructure won’t cut it. Closed AI models that ignore this? They’ll get undercut every time by open-source alternatives maximizing performance with limited resources. This is now a game of efficiency and optimization. Only the best optimizers survive.

Open source has turned AI models into commodities, and margins are too thin to justify massive infrastructure spending—especially short-term, where inference demand lags behind training. Result? Only a handful of players (Microsoft/OpenAI, Amazon, Google, Meta) will keep training models while squeezing every drop of performance from their GPUs to slash costs.

Don’t overlook ASIC chip providers like Groq, Google TPU, AWS Trainium, and Broadcom, all racing to build cheaper, more efficient alternatives to NVIDIA GPUs. An H100 costs $30,000–$40,000; AMD’s MI300X is $10,000–$15,000. AMD even optimized DeepSeek R1 for its MI300X, letting smaller AI providers deploy R1 at a fraction of hyperscalers’ costs.

Cheaper inference chips like AMD’s MI300X and Intel’s Gaudi GPUs will follow suit, ensuring open-source models are compatible with their hardware the second they launch. This lets every chipmaker undercut NVIDIA on price. The more powerful open-source models proliferate, the less NVIDIA dominates inference—users will just run them affordably on their own infrastructure. Short-term? NVIDIA’s margins and revenue could take a hit.

Long-term, though, NVIDIA still remains the strongest player. Their margins might not stay as high, but they’ll stay the backbone of AI development. The CUDA platform—their biggest edge—remains the easiest way to train everything from LLMs to robotics to self-driving cars. There’s no real alternative right now—it’s practically a monopoly. A deep correction in the stock would be a long-term buying opportunity. That said, I’m convinced the current price is overvalued given where things stand today.

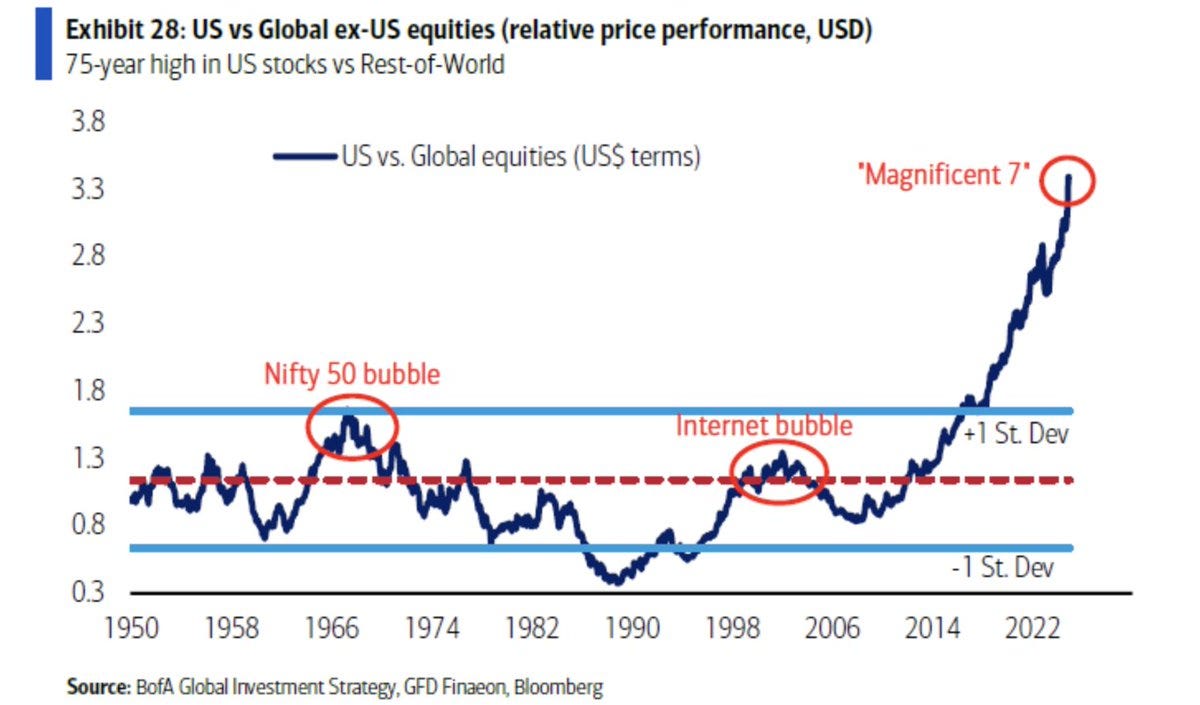

The magnificent 7 AI bubble

The main question on everyone’s mind is: How will this impact the rest of the Magnificent Seven stocks? Having benefited most from the AI trade, these stocks now face potential corrections – whether near-term or down the line. Let’s break them down individually.

Apple (AAPL)

Apple might see a correction – but not because of AI. As you know, Apple’s execution in the AI field has been downright underwhelming. The company faces its own problems, like slumping iPhone sales in China. On top of that, Apple is the least aggressive spender in this sector – no crazy AI investments reported, no partnership with NVIDIA for training their models. They are even renting cheaper Google Cloud TPUs instead of building their own infrastructure.

So any Apple correction tied to this news would likely be minimal or unrelated. That said, the stock could dip broadly due to negative market sentiment. I’m staying NEUTRAL for now – but if we get an overdone sell-off? I would eye it as a BUY.

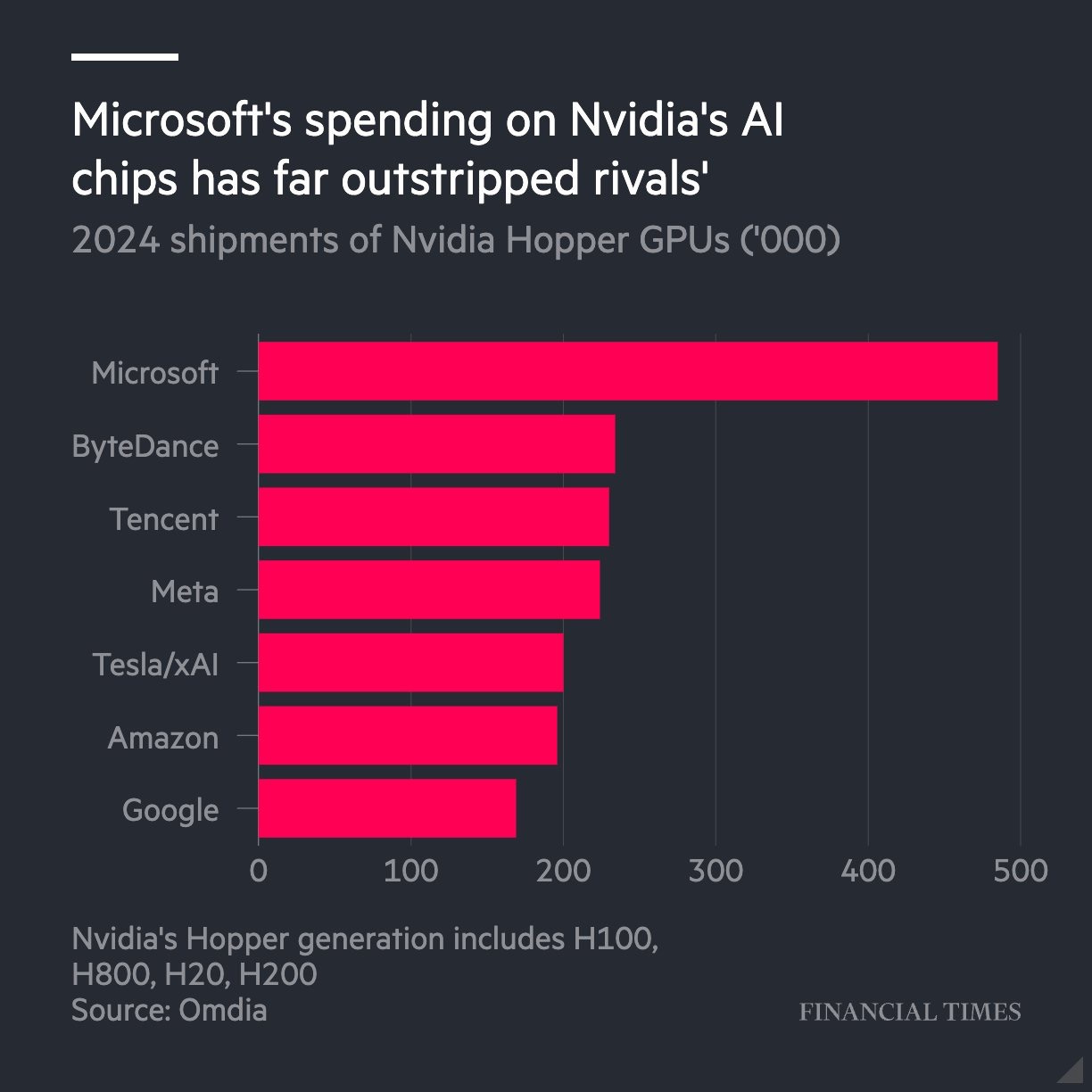

Microsoft (MSFT)

Microsoft is by far the biggest buyer of NVIDIA chips thanks to its OpenAI partnership – which also makes it the most exposed to the DeepSeek open-source model release. Commoditization (and dirt-cheap pricing) of these models directly undermines OpenAI’s value proposition and the existing infrastructure Microsoft’s built. The stock could drop sharply, especially if users flee OpenAI for free alternatives like DeepSeek, jeopardizing their joint venture. Remember: Microsoft’s $10B OpenAI investment relies on profit-sharing to pay off, and that math gets trickier as AI becomes commoditized.That said, all isn’t lost. Satya Nadella – the King of Open Source – has pivoted Microsoft brilliantly before. His playbook? Embrace, don’t fight, the wave. A few examples:

Dumping Internet Explorer for Chromium-based Edge

Open-sourcing Visual Studio Code (now the #1 developer IDE)

GitHub Copilot: Originally OpenAI-powered, but Satya wisely expanded it to support Anthropic’s models too, making it more versatile.

Bottom line: Nadella understands open source’s power better than anyone. While Microsoft’s heavy OpenAI/Infra bets look shaky short-term, Azure could pivot to dominate the commoditized AI future. They’re poised to offer open-source models as APIs (like "R1" or others) and integrate cheaper, leaner models into their own products – slashing costs while keeping enterprise customers hooked.

Short-term? MSFT might stumble if OpenAI falters. Long-term? Azure becomes the Walmart of AI models – lower margins, but massive volume. Any stock dip here is a buying opportunity.

Alphabet (GOOGL)

Google’s search business faces daily threats from AI startups like OpenAI, Perplexity, and DeepSeek – all offering competing search tools. This is very bearish for the stock, especially if user attrition accelerates. Alphabet bought fewer NVIDIA chips than other hyperscalers, leaning instead on its cost-effective TPU ASICs and in-house AI models. But their late, botched rollout in the AI race left their models lagging behind DeepSeek and OpenAI in popularity. Even their Gemini lineup hasn’t sparked much developer excitement.The silver lining? Google’s scrambling to catch up. They’re integrating AI responses directly into search results – a move that risks cannibalizing search ad revenue but could help retain users. Their ad network remains unmatched (thanks to cash cows like AdSense, AdMob, YouTube and Gmail, which aren’t threatened by AI… yet). Right now, Google’s survival hinges on keeping users glued to its ecosystem at all costs.

Long-term, I’m cautious – particularly on their ad business. I’ll be watching search revenue trends like a hawk to gauge if the stock’s worth buying. That said, Alphabet’s entrenched ad dominance means any short-term, panic-driven sell-off could be a golden chance to scoop up shares.

Amazon (AMZN)

Amazon is known for doubling down on "frugal" culture – they’re all about doing more with less, cutting fluff, and pushing self-reliance (it’s literally one of their leadership principles). That’s why this DeepSeek R1 news makes sense for AWS adoption since it was trained at a fraction of the cost. Don’t forget, Amazon is already making their own AI chips – Trainium (training) and Inferentia (inference) – which screams efficiency and capital discipline. Plus, AWS could host not just Amazon’s proprietary models but also serve up open-source options like R1. In the long-term, I am bullish. Short-term, there might be a negligible bearish sentiment about their Anthropic investment looking shaky against DeepSeek.Tesla (TSLA)

Tesla might see a small correction too, but not because of DeepSeek – their business and AI focus are totally different. If you think about it, this is actually bullish for Tesla, especially if NVIDIA ends up slashing GPU prices. Tesla could get way more bang for their buck.Meta Platforms (META)

Meta’s the biggest winner in this whole debacle. Their goal with releasing open-source Llama models was always to commoditize AI and avoid getting left behind in case of a breakthrough. Well, DeepSeek just delivered that breakthrough. There’s speculation that R1 is already better than the upcoming Llama 4 model. Now, Meta gets to release an even better open-source model that they can also use internally. While all this sounds bullish for Meta, investors still haven’t seen clear revenue signals from all this Capex. Long-term, if tangible revenue doesn’t materialize, investors might sell the stock – just like they did in the past with all the metaverse Capex.

Overall, I’m neutral on Meta in the short term but slightly bullish in the long term.

If you enjoyed this writing, feel free to leave a comment. My name is Yaovi Kwasi Founder and CTO of Charly AI. Charly AI was born from my struggle to cut through market noise and pinpoint winning stocks—a tool I wish I’d had earlier. It wasn’t until my portfolio crossed the seven-figure threshold that the weight of informed decision-making truly hit home. Drawing on my background architecting AI systems at Microsoft, I engineered a solution that thinks like a hedge fund analyst, processes data like a supercomputer, and turns complex market patterns into actionable insights for building serious wealth.

Checkout Charly AI at https://www.askcharly.ai

I predicted this will happen.

"MICROSOFT - DEEPSEEK R1 IS NOW AVAILABLE ON AZURE AI FOUNDRY AND GITHUB"

https://azure.microsoft.com/en-us/blog/deepseek-r1-is-now-available-on-azure-ai-foundry-and-github/