Is This Stock The Next Southeast Asian Giant?

This Company's Superapp Strategy Is Delivering — But Is the Stock a Good Buy?

This newsletter has now moved to https://www.askcharly.ai/alpha

The company…

Grab Holdings (GRAB) is Southeast Asia’s dominant superapp, offering a suite of services including ride-hailing, food and grocery delivery, digital payments, micro-lending, insurance, and in-app advertising — all integrated into one platform. Operating in eight countries, Grab has become a daily essential for millions of users in markets like Indonesia, Vietnam, Malaysia, and Singapore. What makes Grab unique is its role as both a consumer app and an economic empowerment engine for gig workers and small businesses. Over 44 million people use Grab’s services monthly (MTUs), yet this represents only 6% of the region’s population; leaving significant runway for expansion. The platform is deeply embedded in local infrastructure, from logistics to payments, which gives it strong competitive moats in fragmented and regulation-heavy markets.

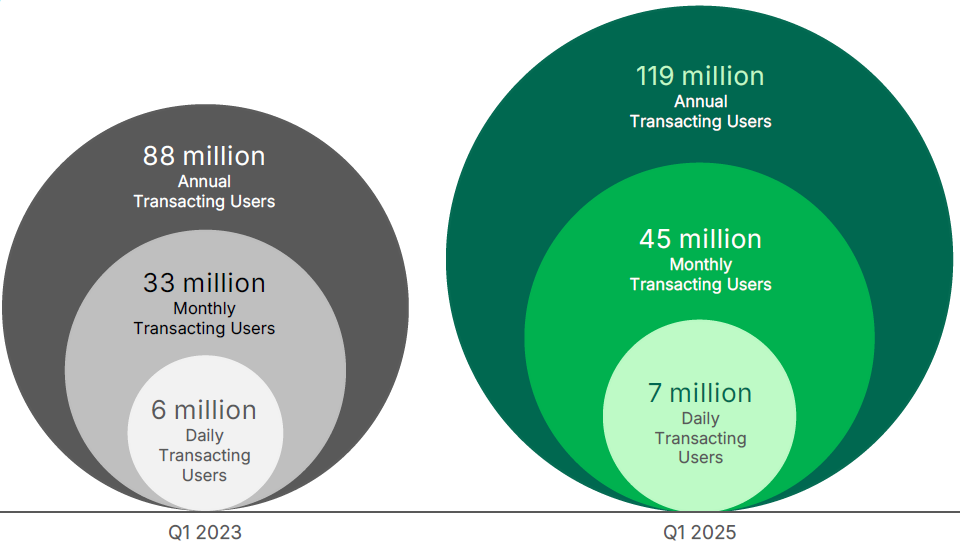

Figure 1. Grab transacting users

Source. Grab website, May 2025

The business model…

Grab generates revenue through four main channels. Commissions: this is the core of its business. Grab earns a percentage from each transaction made on its platform, whether it’s a ride, a meal delivery, or a grocery order. These fees are typically charged to drivers, merchants, or both. Financial Services: GrabFin and its digital banks offer services like personal and merchant loans, insurance, and digital wallets. Revenue comes from interest income, loan fees, and payment processing charges. The loan portfolio grew 56% YoY in Q1 2025, with annualized disbursals reaching $2.5 billion. Advertising: Grab monetizes its merchant base with targeted ad placements. Its self-serve ad platform, mostly used by small businesses, has scaled quickly. Advertising now accounts for 1.7% of Deliveries GMV, up from 1.3% last year. Subscriptions & Fees: Other sources include cancellation charges, driver subscriptions, premium ride bookings, and merchant software tools.

Grab’s business model benefits from strong network effects: more users attract more drivers and merchants, which improves reliability and service quality, encouraging even more usage. The company’s ability to cross-sell products also raises average revenue per user at minimal acquisition cost.

The financials…

Grab posted strong results in Q1 2025: Revenue: $773M, up 18% YoY. Net Income: $10M, a $125M swing from a $115M loss last year. Adjusted EBITDA: $106M, up 71% YoY. Operating Cash Flow: $73M and Free Cash Flow: -$101M.

Deliveries and Mobility remain the largest segments, generating $415M and $282M in revenue respectively. Financial Services, while smaller at $75M, is the fastest-growing vertical. Gross margin expanded to 41.9%, and operating loss narrowed significantly from $75M to $21M. Grab’s balance sheet is strong: it holds $6.2 billion in liquidity and $5.9 billion in net cash. However, stock-based compensation remains high at $80M — 8x net income — and the share count rose 3.8% YoY, leading to modest dilution. Despite profitability, free cash flow remains negative due to heavy capex and working capital outflows.

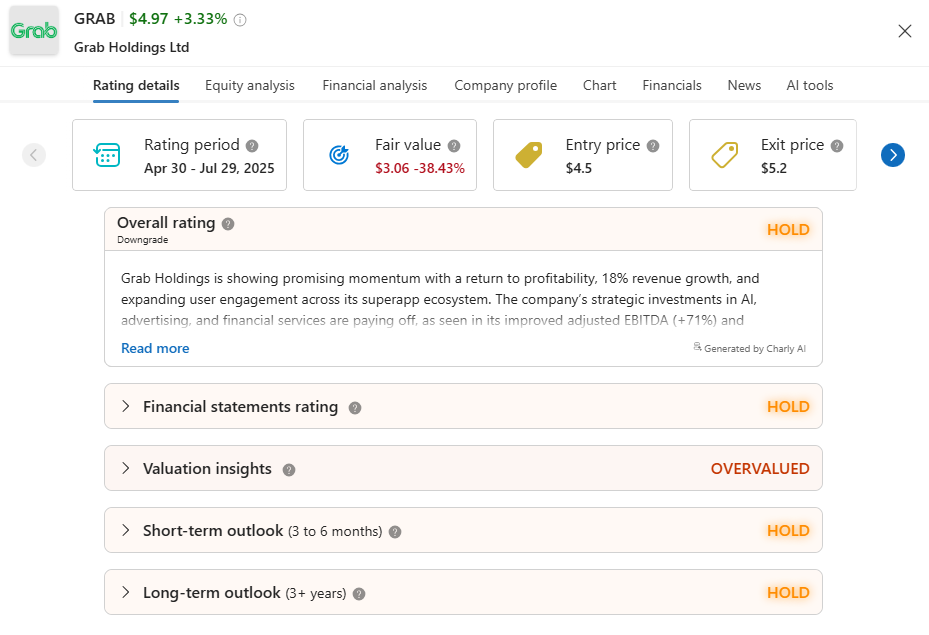

Charly AI rating…

Overall, Charly AI rates Grab as a “HOLD,” broken down as follows: “HOLD” for its financials, short- and long-term outlook, and “Overvalued” for valuation. This is mainly because the stock’s current valuation appears stretched relative to fundamentals (Estimated Fair Value of $3.06 vs. current $4.97 price), and despite strong top-line performance, Grab’s thin profit margins (1.3% operating margin) and high stock-based compensation (8× net income) raise questions about sustainability.

Figure 2. Charly AI rating

My investment thesis…

Grab’s superapp model is working. Revenue is growing, profitability has arrived, and user engagement is high. The company is successfully deepening monetization while expanding into financial services and advertising — high-margin verticals with long-term upside. But challenges remain. Free cash flow is negative, share dilution is ongoing, and stock-based compensation is eating into profits. With the stock trading above its fair value, investors should be cautious. If you're conservative, wait for signs of stronger free cash flow before buying. If you're bullish on Southeast Asia’s digital economy — especially with a potential M&A catalyst on the horizon — a small position may be justified. For now, Grab is a HOLD — a strong business at a price that already reflects much of the good news.

Like what you read? Reach out at daniel@askcharly.ai for more emerging market tech insights.