Nancy Pelosi’s Portfolio: The Unknown Stock That Could Skyrocket!

AllianceBernstein Holding L.P. (AB) has shown significant progress in its business operations and financial performance. Recent developments include a strategic partnership with Reinsurance Group of America to expand its insurance platform, and the launch of a new balanced direct index platform combining equities and municipal bonds. The company reported a decrease in assets under management (AUM) to $793 billion in October 2024, primarily due to market depreciation. Despite this, AB has maintained positive net flows in its retail segment, particularly in fixed income and alternative investments. The company’s stock has experienced some volatility, with a recent decline in market price, but it remains a strong player in the investment management industry.

Fundamental Analysis

Revenue and Profitability

AB reported net income of $127.2 million for Q3 2024, a significant increase from $56.9 million in Q3 2023. This growth was driven by higher net income attributable to AB Unitholders and a stable fee rate. The company’s effective tax rate decreased to 6.7% from 13.3% in the previous year, contributing to improved profitability. The firm’s operating margin also improved, reflecting better cost management and increased revenues from management fees.

Strategic Positioning

AB is focusing on expanding its private markets platform and enhancing its insurance offerings through strategic partnerships. The company is also investing in new product launches, such as the AB CarVal Credit Opportunities Fund, to tap into growing markets like Asia and the U.S. high net worth segment. These initiatives are expected to support long-term growth and strengthen AB’s competitive position in the asset management industry.

Risks

Key risks for AB include market volatility, regulatory changes, and competitive pressures. The company’s reliance on market performance for AUM growth makes it vulnerable to economic downturns. Additionally, regulatory challenges in different regions could impact its operations and profitability. AB’s management is focused on mitigating these risks through diversification and strategic partnerships.

Technical Analysis

Price Movements

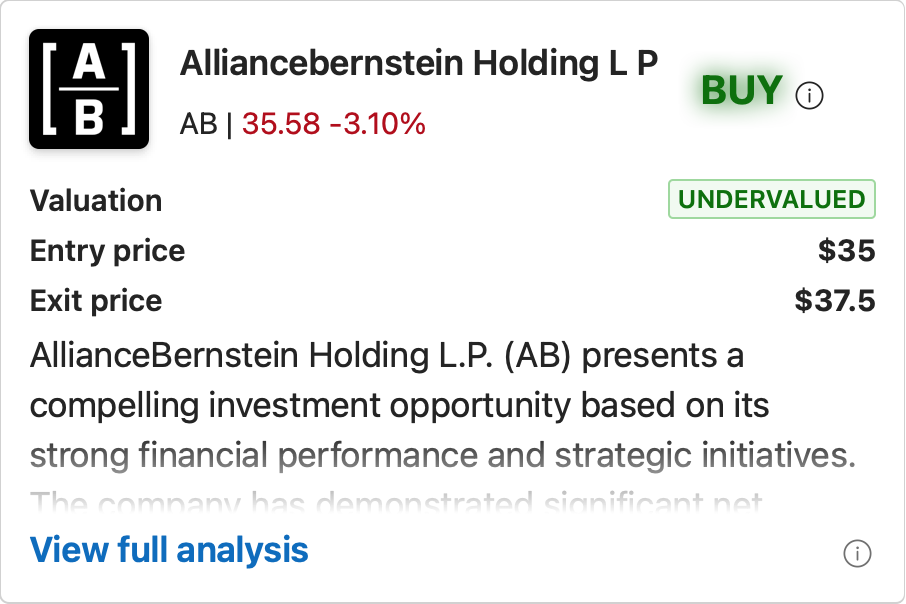

AB’s stock has shown volatility, with a recent decline in market price to $35.58. The stock has a 52-week range of $27.58 to $38.96, indicating significant fluctuations over the past year.

Key Indicators

The Relative Strength Index (RSI) is around 53, suggesting a neutral position. The Moving Average Convergence Divergence (MACD) indicates a bearish trend, with the MACD line below the signal line. The stock is trading below its 50-day moving average of $36.22, but above its 200-day moving average of $34.33, suggesting mixed signals.

Support and Resistance Levels

Key support levels are around $35, with resistance at $37.50. These levels provide potential entry and exit points for investors.

Investment Recommendation

Valuation Insights

AB’s current P/E ratio is 10.22, which is relatively low compared to industry peers, suggesting the stock may be undervalued. The market capitalization is approximately $4.04 billion. Given the company’s strong fundamentals and strategic initiatives, the stock appears to be a good value investment at its current price.

Short-term Outlook (3 to 6 months)

The short-term outlook for AB is positive, with strong market conditions and financial performance. The company’s strategic initiatives and stable cash flow support a BUY recommendation. The stock is expected to rise, given its undervaluation and positive momentum in key business segments.

Long-term Outlook (3+ years)

AB is well-positioned for long-term growth, with strong fundamentals, strategic investments, and a competitive market position. The company’s focus on expanding its private markets and insurance platforms supports a BUY recommendation for long-term investors. The potential for continued growth in AUM and profitability makes AB an attractive investment for the future.

Exciting news! Charly’s stock rating engine is launching soon. Make sure to follow us on Twitter so you don’t miss the big reveal! https://x.com/charly___AI

Disclaimer: The information provided in this analysis is for informational purposes only and should not be considered financial or investment advice. Investors are encouraged to perform their own research and consult with a financial advisor before making any investment decisions.