3 Stocks All Value Investors Should Avoid

High Debt, Falling Profits: 3 Stocks to Avoid Right Now

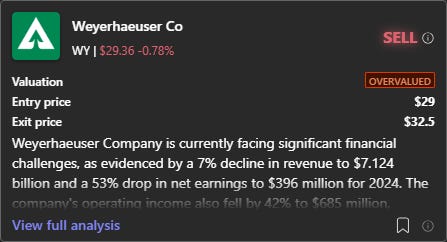

3. Weyerhaeuser Co - WY

Description: WY is one of the world's largest private owners of timberlands, the company owns or controls approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. WY manages these timberlands on a sustainable basis in compliance with internationally recognized forestry standards, and is one of the largest manufacturers of wood products in North America.

Key financials: Market Cap $22bn; P/E ratio 54.5; Operating Margin 10%; Cash Flow $341m, and Debt to Equity ratio (mrq) 0.54.

Bearish Thesis: WY is currently facing significant financial challenges, as evidenced by a 7% decline in revenue to $7.1 billion and a 53% drop in net earnings to $396 million for 2024. The company's operating income also fell by 42% to $685 million, indicating reduced profitability. The high P/E ratio of 54.5 suggests the stock is overvalued compared to industry peers, and the bearish technical indicators, such as the MACD and RSI, point to downward momentum. Additionally, the company has more debt ($5,076 million) than cash ($684 million), which is a negative indicator of financial health. The decrease in cash from $1,164 million in 2023 to $684 million in 2024 further highlights potential liquidity issues. Despite strategic investments in climate solutions and engineered wood products, the short-term outlook is negative due to declining revenue, profitability, and cash flow, along with high market volatility. Therefore, the recommendation is to SELL the stock, as the negative financial trends and overvaluation outweigh the potential long-term benefits of strategic investments.

2. Microchip Technology Inc - MCHP

Description: MCHP engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit mixed-signal microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

Key financials: Market Cap $26bn; P/E ratio 89.6; Operating Margin 13%; Cash Flow $970m, and Debt to Equity ratio (mrq) 1.12.

Bearish thesis: MCHP is navigating a tough period marked by sharp declines in revenue (down 41.9% year-over-year) and profitability, driven by weakened demand in key sectors like automotive and broader economic headwinds. Customers are trimming inventories, and higher interest rates and inflation have squeezed spending, leading to a net loss of $53.6 million last quarter. Gross margins (54.7%) also contracted due to lower sales volume and unfavorable product mix, while rising debt ($6.75 billion) and a cash balance ($586 million) that’s insufficient to cover obligations add financial strain. The balance sheet looks fragile, with intangible assets making up over half of total assets, limiting liquidity, and retained earnings shrinking as profitability falters.

Despite these challenges, there are glimmers of strategic adjustment. The company is cutting costs by closing facilities and repurchasing shares, which could support long-term efficiency. Technically, the stock is nearing oversold levels (RSI ~30), hinting at a potential short-term bounce, but the MACD signals a persistent downward trend. While management’s focus on new technologies and product expansion might eventually stabilize the business, the near-term risks—overvaluation, high debt, and uncertain demand recovery—overshadow these efforts. For investors with a longer horizon, holding could make sense if the turnaround gains traction, but the current combination of weak fundamentals and bearish momentum tilts the scale. The recommendation is to SELL, as the immediate risks outweigh the potential for recovery, and patience here could mean further downside before any meaningful rebound.

1. Boeing - BA

Description: BA, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through three segments: Commercial Airplanes; Defense, Space & Security; and Global Services.

Key financials: Market Cap $130bn; Operating Margin -16%; and Cash Flow -$14m.

Investment thesis: BA is currently facing important financial and operational challenges. The company's revenue has decreased by 14.5% year-over-year, and it reported a substantial net loss of $11.8 billion in 2024. The gross margin has also declined, indicating increased production costs and inefficiencies. Boeing's debt levels are high, with $53.9 billion in total debt compared to $13.8 billion in cash, which is a negative indicator of financial health. Additionally, the company has issued a large number of shares, leading to potential dilution of shareholder value. The technical analysis shows that the stock is overvalued, and the stock price is volatile. The short-term outlook suggests a SELL recommendation due to ongoing production challenges and geopolitical risks, while the long-term outlook suggests a HOLD due to potential strategic improvements. However, the financial statement analysis strongly supports a SELL recommendation due to the overall negative financial health and high risks. Therefore, the overall recommendation is SELL, as the negative financial indicators and risks outweigh any potential positive developments.