Two Undervalued Small Cap Nobody Is Talking About

Overlooked & Thriving: Small Cap Stocks

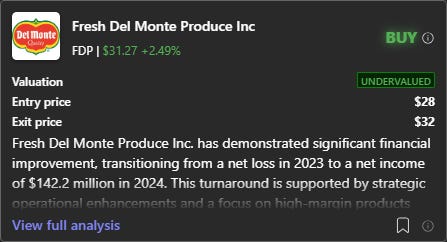

1- Fresh Del Monte Produce (FDP)

Description: FDP through its subsidiaries, produces, markets, and distributes fresh and fresh-cut fruits and vegetables in North America, Central America, South America, Europe, the Middle East, Africa, Asia, and internationally.

Key financials: Market Cap $1.5bn; P/E ratio 10.3; Operating Margin 4%; Cash Flow $129m, and Debt to Equity ratio (mrq) 0.21.

Investment thesis: FDP has demonstrated significant financial improvement, transitioning from a net loss in 2023 to a net income of $142.2 million in 2024. This turnaround is supported by strategic operational enhancements and a focus on high-margin products like pineapples and avocados. The company has also successfully reduced its long-term debt by 39% to $244 million, indicating strong cash flow management. Despite a slight decline in revenue, the company has improved its gross margin from 8.1% to 8.4%, and its operating income has increased significantly. The strategic initiatives, such as the licensing agreement with The Nunes Company and the focus on specialty ingredients, align with long-term growth prospects. Despite risks like competitive pressures in the banana market and adverse weather conditions, the benefits outweigh the challenges. To learn more about FDP click here.

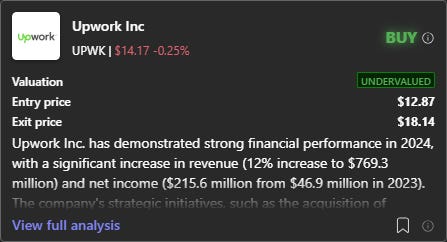

2 - Upwork (UPWK)

Description: UPWK operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally. The company's work marketplace provides access to talent with various skills across a range of categories, including administrative support, sales and marketing, design and creative, and customer service, as well as web, mobile, and software development.

Key financials: Market Cap $1.9bn; P/E ratio 9.3; Operating Margin 8%; Cash Flow $139m, and Debt to Equity ratio (mrq) 0.64.

Investment thesis: UPWK has demonstrated strong financial performance in 2024, with a significant increase in revenue (12% increase to $769.3 million) and net income ($215.6 million from $46.9 million in 2023). The company's strategic initiatives, such as the acquisition of Objective AI and restructuring efforts, are expected to enhance its platform capabilities and drive future growth. Despite a 3% decline in Gross Services Volume, the company's improved gross margin (77% from 75%) and reduced sales and marketing expenses (16% decrease) indicate effective cost management and operational efficiency. While there are concerns about high stock-based compensation (32% of net income) and lower operating cash flow compared to net income, the company's strong cash position ($305.8 million) and lack of new debt issuance provide financial stability. The reduction in accumulated deficit and share repurchase further enhance shareholder value. To learn more about UPWK click here.

Let me know in the comment, if you are familiar with these stocks and whether they are already part of your portfolio or not. If you have any questions, drop me an email at daniel@askcharly.ai.