The Boring Stocks That Will Save Your Portfolio

Boring But Bulletproof

0. The context

Back in early March, I wrote a quick piece that I posted here and on Blind, spotlighting two undervalued stocks that weren’t getting the attention they deserved (Fresh Del monte Produce and Upwork). While the feedback overall was positive, a comment really stuck with me (Figure 1). It got me thinking — are we entering an era where strong, stable, cash-generating businesses are being overlooked simply because they don’t scream “tech” or “AI”?

Figure 1. Teamblind.com user’s comment on FDP

The market's obsession with innovation has left traditional “boring” companies — those in capital-intensive, interest-dependent sectors — largely ignored. But here’s the thing: these businesses often act as the ballast in a portfolio, especially during downturns. They may not 2x in a quarter, but they do offer something invaluable: resilience. And in today’s environment of fear and macro uncertainty, that matters more than ever.

In this piece, I’ll highlight two such “boring day” stocks — that are navigating the current turmoil with surprising grace. Think: stable fundamentals, smart capital allocation, and a business model that thrives even when the macro gets messy. These aren’t the stocks you'll hear hyped on social media, but they might just be what your portfolio needs to stay grounded.

1. Progressive Corp — PGR

Description: The Progressive Corporation operates as an insurance company in the United States. The company writes insurance for personal autos and special lines products, including motorcycles, RVs, and watercraft; and personal residential property insurance for homeowners and renters.

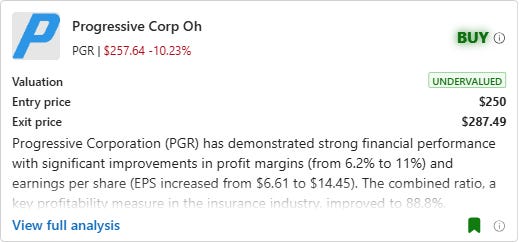

Figure 2. PGR stock rating card by Charly AI

Investment thesis: Year to date PGR is 7% up vs S&P 500 which is 14% down. PGR has demonstrated strong financial performance with significant improvements in profit margins (from 6.2% to 11%) and earnings per share (EPS increased from $6.61 to $14.45). The combined ratio, a key profitability measure in the insurance industry, improved to 88.8%, indicating better cost management. The company's strategic investments in technology and product innovation, such as usage-based insurance programs, position it well for future growth. Despite some concerns about operating cash flow being lower than net income, the overall financial health is robust, with stable cash balances and minimal share dilution. The stock is currently undervalued based on a DCF analysis, with an intrinsic value suggesting a margin of safety. Given the strong short-term and long-term growth prospects, along with a bullish technical trend, a BUY recommendation is appropriate. The potential risks, such as competitive pressures and regulatory challenges, are mitigated by Progressive's strong market position and strategic initiatives.

2. Verizon Communications — VZ

Description: Verizon provides communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

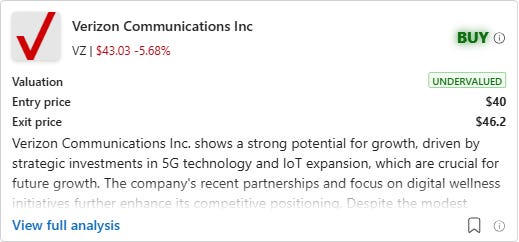

Figure 2. VZ stock rating card by Charly AI

Investment thesis: Year to date VZ is 8% up vs S&P 500 which is 14% down. Verizon’s stock outlook is cautiously optimistic, balancing its strategic growth initiatives with lingering financial risks. The company is making strides in expanding its 5G network, IoT partnerships, and fiber infrastructure, which should drive long-term growth. These efforts are already showing results, with the Consumer segment growing (1.3% revenue increase) and net income rising sharply to $17.95 billion in 2024, supported by cost reductions and tax efficiencies (effective tax rate down to 21.9%). Additionally, Verizon’s high dividend yield (6.13%) and undervaluation (P/E of 11.13) make it appealing for income-focused investors. However, challenges remain, including a declining Business segment (-2.0% revenue) and a high debt load ($144 billion), though debt is decreasing and cash flow remains strong (operating cash flow of $36.9 billion).

The stock’s technical indicators suggest positive momentum, with bullish MACD signals and a recent price uptrend. While the Business segment’s struggles and past goodwill impairments ($5.8 billion in 2023) warrant caution, Verizon’s focus on high-growth areas like IoT and cybersecurity partnerships positions it to offset these weaknesses. For investors with a moderate risk tolerance, the combination of reliable dividends, strategic investments, and improving financial health (free cash flow up to $19.8 billion) supports a BUY recommendation. The stock’s current valuation and growth potential outweigh near-term risks, making it a compelling choice for both income and growth-oriented portfolios.