Why Onsemi is a BUY for long-term investors?

Onsemi’s Key Role in EV, industrial, and Energy Markets

Let’s start with the bad news. In the past 12 months, Onsemi's stock price declined by 26% (Figure 1). This was driven by a reduction in revenue due to a downturn in the company’s end markets, which negatively impacted its financial performance.

Figure 1. Onsemi stock price chart

Source: Yahoo Finance

Onsemi: the chip manufacturer powering EV, industrial automation and clean energy. For those unfamiliar with Onsemi, the company is a semiconductor manufacturer that focuses on the automotive (54% of Q3 2024 revenue), industrial (25%), and energy & other industries (21%). In automotive, its power technology chips are used in electric vehicles (EVs) to enable proper charging and efficient energy use, while its sensor and imaging solutions are used in advanced driver assistance systems (ADAS). In industrial, Onsemi's power and motor control solutions are used for automation, and its sensors for safety and precision in robotics. In energy, Onsemi chips facilitate the conversion of sunlight into usable electricity in solar panels and improve energy efficiency in data centers. Additionally, its IoT (Internet of Things) solutions optimize connectivity. Unfortunately for Onsemi, its end markets have been in a downturn in the past year or so due to the macroeconomic slowdown, high interest rates, weaker demand, etc.

Figure 2. Onsemi products by type in a car

Source: Onsemi Q3 2024 earnings presentation

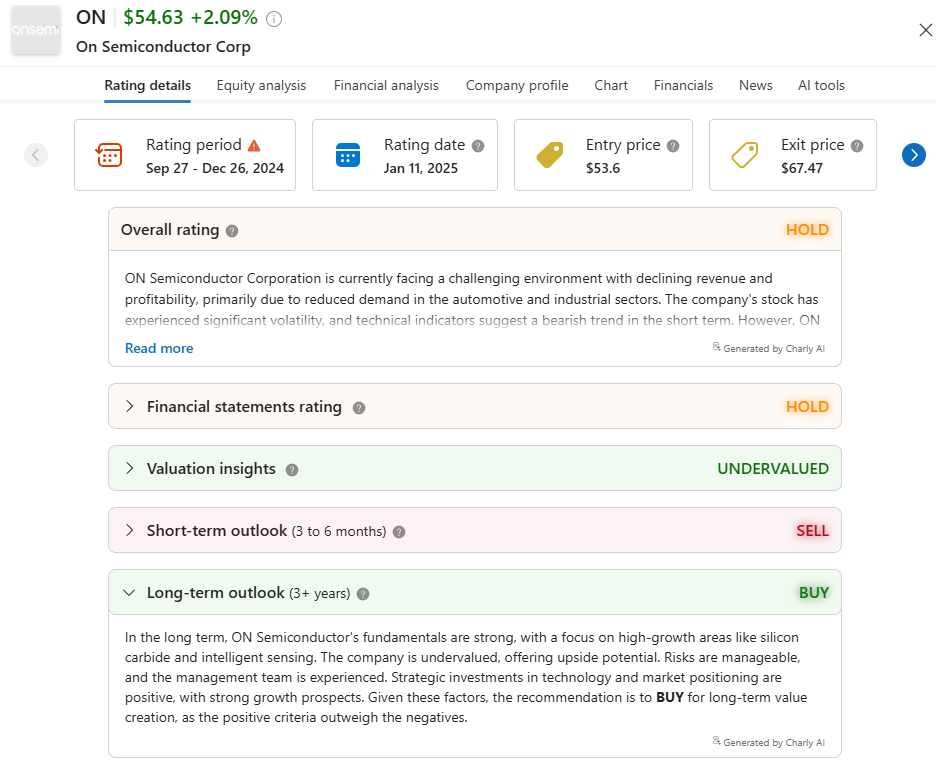

Overall, Onsemi is currently rated HOLD by Charly AI (Figure 3). For the short term (3 to 6 months), the stock is rated SELL because its end markets are not expected to recover during that period. Analysts on Wall Street agree with this outlook, which explains why they lowered their target prices on the stock last week. In the long term, Onsemi is rated BUY by Charly AI because the company has healthy financials; is well-positioned in its end markets; and has a positive long-term outlook.

Figure 3. Onsemi rating by Charly AI

Source: Charly AI

Onsemi maintained positive free cash flow and made two acquisitions during the downturn. Its financials are rated HOLD by Charly AI because of the decline in revenue and margin, which are industry-related, as explained above. Through this downturn, Onsemi still delivered free cash flow (14% of revenue in the last 12 months) and maintained a strong cash level, unlike its peers ($2.4bn at the end of Q3 2024). The company leveraged its cash position to acquire players in financial difficulties at a discount. In July 2024, Onsemi acquired a specialist in short-wave infrared imaging technology, and in December 2024, it acquired the Silicon Carbide (SiC) JFET technology business, including the United Silicon Carbide subsidiary, from Qorvo.

Onsemi is well-positioned to leverage long-term growth. In the months prior to the downturn, Onsemi started downsizing its manufacturing capacity by consolidating its plants and reducing its workforce. In addition, the company exited price-sensitive segments to focus on high-growth areas like silicon carbide (SiC) chip production for electric vehicles and data centers. Its recent acquisitions enabled Onsemi to strengthen its leadership in SiC and sensor imaging. Currently, Onsemi is the leader in ADAS (68% market share) in EVs, and in sensor solutions in industrials (27% market share).

Onsemi's end markets are expected to start recovering in a year or less. On the EV side, laws are in place to phase out ICE vehicles by 2035. In Europe and the UK, a full phase-out is expected, while in the USA, it is projected that 50% of car sales will be EVs by 2035. China is ahead of the west in this EV transition process. An improved macroeconomic situation and/or potential subsidies would accelerate the EV transition. Historically, the industrial and energy sectors have shown patterns of recovery. Experts predict Onsemi's end markets to start a gradual recovery from late 2025 onwards.

Figure 3. Onsemi total addressable market size in 2022 and growth outlook, 2022-27

Source: Onsemi Q3 2024 earnings presentation

Onsemi is undervalued, trading at 13 P/E, offering a compelling entry point at $54. In addition to healthy financials and a positive long-term outlook, Onsemi is currently undervalued, trading at a P/E ratio of 13 with a market capitalization of $23bn at the time of writing. Charly AI estimated Onsemi's entry price at around $54 and its exit price at $67. With the stock trading at $55 at the time of writing, this represents a good opportunity for long-term investors to start taking positions and monitor the stock further. Personally, I bought some shares of Onsemi a week ago at $56, and I will continue buying more until it reaches $60. For me, a company that is undervalued, capable of delivering cash flow in a downturn, and has a strategic position in high-growth markets is a BUY every day of the week when the price is right.